When to Update Your Estate Plan

What Should Trigger a Review of Your Estate PlanKnowing when to update your estate plan is crucial to ensure it aligns with your changing life circumstances and evolving financial goals. In this guide, we'll explore the key milestones and life events that may necessitate updates to your estate plan.

|

We're Here to Help.OR

|

Why Update Your Estate Plan?

Estate planning is not a one-and-done process; it's a dynamic strategy that should evolve with your life. Here are some important reasons to consider updating your estate plan:

1. Changing Laws:

1. Changing Laws:

- Estate laws, tax regulations, and inheritance laws can change over time. Regularly reviewing your plan ensures it complies with the most current legal requirements.

- Significant life events like marriage, divorce, or the birth of a child can impact your estate plan. Ensuring it reflects your new family structure and responsibilities is essential.

- As your assets grow, your estate plan may require adjustments to optimize tax strategies and asset distribution.

- Changes in relationships, such as remarriage or the death of a spouse, may necessitate updates to your beneficiaries and designated representatives.

- As you age, planning for long-term care and Medicaid eligibility becomes crucial. Updating your plan can help protect your assets and plan for future healthcare needs.

- Don't forget to review beneficiary designations on life insurance and retirement plan accounts, as these assets pass outside of probate and should align with your overall estate plan.

Key Milestones for Estate Plan Updates

- Relocation to Another State: If you move to a new state, review your estate plan to ensure it complies with the local probate and estate tax laws.

- Divorce: After a divorce, update your estate plan to remove your ex-spouse from key roles and consider new arrangements for your assets.

- Death of a Spouse: Major revisions are often needed to adapt to the loss of a spouse, including changes to beneficiaries and asset distribution.

- Remarriage: Second marriages often require complex planning, especially when children from previous marriages are involved. Pooling estate tax exemptions may also be considered. Read more about estate planning considerations for blended families.

- Empty Nesting: As children become independent adults, your estate planning goals may shift. You can now focus on legacy planning and asset distribution to your children directly. You may also want to consider making a plan for asset protection in case you or your spouse needs assited living.

- Birth or Adoption: Welcoming a child warrants updating your estate plan to appoint guardians and establish trusts for their financial security. Read more about estate planning considerations for young families.

- Inheritance: Receiving a substantial inheritance may necessitate estate tax planning that wasn't required before.

Don't Forget Your Non Probate Assets

At each of these stages, remember that you have certain assets that will distribute automatically outside of probate. These are included in your estate for tax purposes, but changes to your estate planning documents will not change those distributions unless you do. Any time you decide to review and update your estate plan, you should also check the beneficiary designations on your life insurance and retirement plan accounts to make sure they are still consistent with what you want.

Conclusion

Regularly updating your estate plan ensures that it continues to protect your loved ones and reflect your changing circumstances. Whether you're experiencing major life events or simply reaching new milestones, our experienced estate planning attorneys at slnlaw are here to guide you through the process and ensure your estate plan remains effective and up-to-date.

Need Help Understanding Whether You Need to Update Your Estate Plan?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Meet Our Estate Planning Lawyers

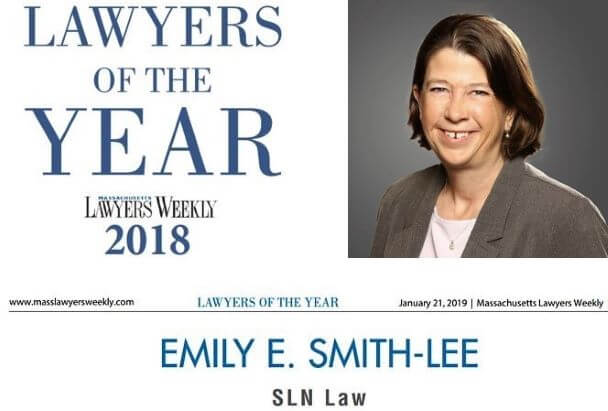

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

At slnlaw, our dedicated team specializes in helping individuals and families navigate estate planning updates. We provide personalized guidance to ensure your estate plan aligns with your evolving circumstances and legal requirements. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.