Navigating the Aftermath of Losing a Loved One: A Comprehensive Guide

|

Losing a loved one is an emotional and overwhelming experience. In the pages that follow, we provide a step-by-step guide to help you navigate this challenging period. This guide will help you understand what immediate actions to take, what can wait, how to deal with legal matters like probate, and more.

|

We're Here to Help.OR

|

What to Do and When: a Checklist

Our comprehensive "What to Do When a Loved One Dies" checklist offers guidance, support, and reassurance. It's designed to help you navigate the complex terrain that follows a loved one's passing. This checklist includes:

- Immediate actions, such as notifications and safeguarding assets.

- Legal and administrative tasks to address shortly after death, including obtaining a death certificate, locating important documents, secondary notifications, and consulting legal and financial professionals.

- Tips for planning a memorial service or celebration of life.

- An inventory of assets and accounts, including insurance policies, survivor benefits, jointly held bank accounts, and real property.

- Understanding the probate process and necessary first steps.

- Suggestions for seeking support for yourself and your family.

Understanding the Legal Landscape

Even if you're not ready to address these steps immediately, it's essential to grasp the legal landscape to ensure a smoother transition during this difficult time. We're here to help you navigate this process, which includes:

- Identifying assets that can pass without court approval, such as jointly held bank accounts and real property.

- Understanding the limitations of any power of attorney held for the deceased.

- Recognizing which transactions require probate approval.

- Learning how to initiate the probate process for assets requiring court approval.

Understanding Non Probate Assets

Non-probate assets often constitute a significant portion of a person's estate. Distinguishing between probate and non-probate assets is crucial to know which steps are required to access or transfer non-probate assets. Visit this page for an in-depth exploration of assets typically falling into this category.

Understanding the Probate Process

Even if most of your loved one's affairs have been handled through trusts or joint ownership, some assets may still require probate. For example, transferring title to vehicles or personal property may necessitate appointing a personal representative of the estate. This section explains the types of probate proceedings in Massachusetts, how to initiate the process, and considerations about handling it independently or seeking professional assistance.

Funeral Planning and Pre-Planning

When dealing with end-of-life preparations, whether prompted by a recent loss, impending circumstances, or proactive planning, the intricacies can be daunting. This guide delves into the critical aspects of preplanning funerals and their synergy with estate planning. Preplanning offers various advantages, including ensuring arrangements are in place ahead of time and potentially aiding in long-term care eligibility by exempting pre-paid funeral expenses from the five-year look-back rule imposed by Medicaid/Mass Health. Additionally, for those currently planning for elderly family members, there may still be opportunities to simplify post-passing matters, such as avoiding probate or estate taxes. This guide also encourages reflection on your estate plan during this process, as it may reveal areas for improvement and simplification, ensuring your wishes are met and your loved ones are well-prepared.

Need Help Understanding What to Do After the Death of a Loved One?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need.

Meet Our Estate Planning and Probate Lawyers

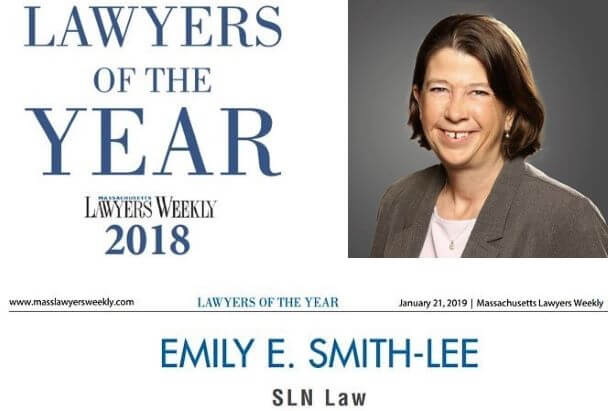

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Our expertise ensures a smoother transition during difficult times. We guide you through legal complexities, probate, and asset distribution. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.