Durable Power of Attorney in End-of-Life Planning

Utilizing the Durable Power of AttorneyEnd-of-life planning involves making crucial decisions about your medical care, financial matters, and the distribution of your assets. One essential legal document that plays a significant role in this process is the Durable Power of Attorney (DPOA). A DPOA is a legal instrument that grants authority to a trusted individual to act on your behalf in financial, legal, and other important matters. It can be a critical tool when facing a terminal illness or hospitalization, ensuring your affairs are managed according to your wishes.

However, it's essential to understand that a DPOA loses its authority immediately upon the primary person's death, underscoring the importance of addressing financial needs after death separately. |

We're Here to Help.OR

|

What Is a Durable Power of Attorney (DPOA)?

A Durable Power of Attorney is a legal document that designates an agent, often a family member or close friend, to make decisions and take actions on your behalf when you are unable to do so yourself. The "durable" aspect of this document means that it remains in effect even if you become incapacitated, ensuring that your agent can continue managing your affairs when you need it most.

Using DPOA in End-of-Life Situations

When you are facing a terminal illness or hospitalization, your DPOA becomes a crucial tool for handling various financial and legal matters:

- Managing Financial Affairs: Your agent can access your bank accounts, pay bills, and handle financial transactions on your behalf. This is particularly important for ensuring that financial obligations are met promptly, such as medical bills, mortgage payments, or funeral expenses.

- Making Legal Decisions: Your DPOA can make legal decisions, sign documents, and enter into agreements on your behalf. This may include executing necessary legal paperwork related to your medical care or financial matters.

- Asset Protection: Your agent can take steps to protect your assets, ensuring they are managed according to your wishes and minimizing the financial burden on your loved ones.

The Limitation: DPOA Ends Upon Death

One crucial aspect to remember is that a DPOA loses its authority the moment the primary person, also known as the principal, passes away. This means that while a DPOA is invaluable for managing your affairs during a health crisis or terminal illness, it does not cover the immediate financial needs that arise after your death.

Ensuring Immediate Cash Needs After Death

To address the financial needs that arise immediately after your passing, it's essential to plan accordingly. Consider creating a jointly held bank account with a trusted individual who has access rights upon your death. This ensures that there is readily available cash to cover expenses such as funeral and burial costs, outstanding bills, and other urgent financial matters. By combining the use of a DPOA during your lifetime and taking measures for immediate cash needs post-mortem, you can comprehensively manage your financial affairs in end-of-life situations.

Conclusion

In summary, a Durable Power of Attorney is a vital legal document in end-of-life planning, allowing a trusted agent to manage your financial and legal matters during times of incapacity. However, it's crucial to recognize its limitation—its authority ends upon your death. To ensure that immediate cash needs are addressed after your passing, consider proactive measures such as jointly held accounts to supplement the DPOA's role in managing your financial affairs.

Need Help Understanding Your Legal Options When a Loved One is Facing End of Life?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Meet Our Estate Planning and Probate Lawyers

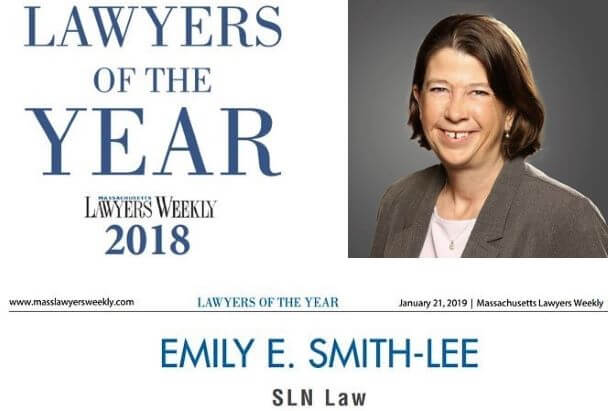

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Our experienced team can guide you in setting up a durable power of attorney to safeguard your financial interests during end-of-life situations. We'll ensure your affairs are well-handled even after your passing. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.