Comprehensive Checklist: When a Loved One Dies

Navigating the Path Forward: Your Comprehensive GuideLosing a loved one is an emotionally overwhelming experience that can leave us feeling lost and uncertain about the next steps. In the midst of grief, the practical and administrative tasks that need attention can seem daunting. It's entirely natural to feel a sense of confusion and helplessness during this challenging time. However, please know that you are not alone, and there is a way forward.

This comprehensive "What to Do When a Loved One Dies" checklist is here to offer you guidance, support, and reassurance. It is designed to help you navigate the often complex and unfamiliar terrain that follows a loved one's passing. By breaking down the necessary actions into manageable steps, we aim to provide you with a clear path through this difficult period, allowing you to focus on honoring your loved one's memory and finding solace in the midst of grief. You can lean on this checklist as a trusted companion, helping you tackle each task with care and compassion. |

We're Here to HelpOR

|

Immediate Actions (Within Hours):

Upon a loved one's passing, it's vital to comprehend the various assets left behind and the steps required to access and manage them. Here's what you need to know:

- Notify the Appropriate Authorities: When faced with the passing of a loved one, there are many administrative details to address. However, one of the first and most crucial steps is to have someone certify the death and determine the cause promptly. If your loved one passed away while in a hospital or under the care of Hospice, the hospital or hospice agency staff should be able to guide you through this process. If the passing occurred at home, it's essential to call 911 to summon first responders who can certify the death. This initial step is a critical part of the process when a loved one has passed away, so it's important to act swiftly.

- Contact a funeral home or crematorium: If your loved one had previously made arrangements with a specific facility, a simple phone call to inform them is all that's necessary. However, if there were no prior arrangements in place, this becomes an urgent matter to ensure that your loved one's remains are handled in compliance with legal requirements and in accordance with their wishes. This step is crucial in the process of honoring your loved one's memory and providing them with the dignified farewell they deserve.

- Notify close family and friends: They will want to know, and their support will be invaluable in the days and weeks ahead. It's essential to remember that you don't need to have all the answers at this moment, and it's natural not to. You can also rely on the connections within your circle of family and friends to help you through this process. For instance, if your loved one had multiple siblings and cousins, consider reaching out to a designated point person in each group and ask them to assist in spreading the news. For most people, ensuring that those closest to the deceased are informed before any public announcements on social media is a priority during this sensitive time.

- Secure and safeguard the deceased person's property: Taking this step is crucial, as even a few days of neglect can lead to undelivered mail or a lack of activity, which may signal to outsiders that the home is unoccupied, potentially increasing the risk of burglary. To help ensure the safety of the property, you might also consider asking a trusted neighbor to keep an informal eye on it during this time. This action is part of the process of responsibly managing your loved one's affairs and protecting their assets.

Legal and Administrative Tasks (Within Days)

During the first few days following the loss of a loved one, there are critical tasks that require immediate attention to ensure that their affairs are handled smoothly. Here are essential steps to take:

- Obtain a Death Certificate: Contact the relevant authority to obtain multiple certified copies of the death certificate. You'll need these copies for various tasks, such as claiming insurance benefits, transferring jointly owned property, and initiating probate proceedings. Many people find it helpful to request 12-14 copies to avoid needing more later.

- Locate the Deceased Person's Will: If your loved one had a will, ideally, you'll know where it's kept. If not, check all the places where they stored important documents, and review their bank records to see if they maintained a safe deposit box. Finding the will can significantly simplify the probate process.

- Notify the Deceased Person's Employer and Business Associates: It's essential to inform your loved one's employer and business contacts about their passing. Not only will they want to know, but there may also be important benefits available to you or other family members through your loved one's employment.

- Cancel Subscriptions and Services: While it may seem like a small detail, canceling subscriptions and services is important. Many of these operate on automatic payments, which can result in unnecessary expenses in the weeks and months following a death. Identify these subscriptions, if possible, through your loved one's email account or by reviewing bank statements for recurring payments.

- Consult with an Estate Planning and Probate Attorney: While you may not need to initiate the probate process immediately, consulting with an attorney who specializes in estate planning and probate is crucial. They can help you understand which assets the family can access immediately and how, as well as what will need to go through probate in the coming weeks. This early consultation will provide clarity and guidance as you navigate this challenging period.

Financial Matters to Address Within the First Few Weeks

During the initial weeks following the loss of a loved one, you may have already taken some financial actions to cover immediate expenses like burial costs and outstanding bills. Nevertheless, it's important to systematically address key financial matters in the weeks that follow. Here's what to consider:

- Identify and File Life Insurance Claims: While you may be aware of major life insurance policies, it's essential to thoroughly review your loved one's files to ensure there are no overlooked policies. Promptly file claims to access the intended benefits.

- Explore Survivor Benefits: If you are the spouse of the deceased, explore potential survivor benefits available through your loved one's employer, Social Security, or, if they were a veteran, through the Veteran's Administration. These benefits can provide crucial financial support during this time.

- Jointly Held Bank Accounts: If you and your loved one held bank accounts jointly, you likely already have signing authority and access to the funds. However, it's advisable to formally transfer these accounts into your name at this juncture.

- Jointly Held Real Property: If real property was jointly held, transferring the title to yourself individually is a straightforward process. You can achieve this by recording an Affidavit of Death along with a certified copy of the death certificate with the Registry of Deeds for the county where the property is located. This step ensures proper ownership of jointly held real estate.

Planning a Memorial Service or Celebration of Life

The timing of planning a memorial service or celebration of life varies based on factors such as your faith, cultural traditions, your loved one's wishes, and whether they will be cremated or buried. If your faith or cultural tradition requires a prompt burial, some of these steps may occur earlier than the legal or administrative tasks mentioned earlier. On the other hand, if you are planning a memorial service or celebration of life for a later date, you can prioritize these tasks accordingly.

While there is no single way to remember a loved one, there are common elements to consider for your checklist:

While there is no single way to remember a loved one, there are common elements to consider for your checklist:

- Selecting a Suitable Location: Choose a location that aligns with your loved one's beliefs or desires and can accommodate the anticipated number of attendees.

- Creating a Guest List and Sending Notifications: Compile a guest list and send out notifications to ensure that family and friends are aware of the upcoming memorial service.

- Arranging for Catering: If you plan to serve food, arrange for catering services to provide for your guests.

- Coordinating Floral Arrangements: Organize floral arrangements and decorations to create a meaningful atmosphere.

- Speaker, Reader, and Music Selection: Decide who will speak, read, or perform music at the ceremony to pay tribute to your loved one.

- Appointing an Emcee: Appoint someone to facilitate or serve as the emcee during the service to ensure it flows smoothly.

- Considering Burial Options: Determine whether there will be an immediate burial following the service, involving all attendees, or if it will take place at a separate time or location with a more intimate group of people.

Commencing the Probate Process in Massachusetts: Important Timelines and Initial Steps

In Massachusetts, you have a three-year window to initiate a probate matter following the passing of a loved one. However, it's crucial to be aware that there are shorter deadlines for specific tasks, such as filing the decedent's final income tax return and an estate tax return. Additionally, certain actions, like transferring vehicle and real estate titles, opening a bank account to hold estate funds, and more, necessitate the appointment of a Personal Representative (Executor).

For a smoother process and to ensure all necessary steps are taken, it is recommended to commence the probate process within a few months of the individual's passing. The complete process of opening probate is explained in detail in our guide titled "Death of a Loved One: Legal Landscape." In summary, here are the initial steps:

For a smoother process and to ensure all necessary steps are taken, it is recommended to commence the probate process within a few months of the individual's passing. The complete process of opening probate is explained in detail in our guide titled "Death of a Loved One: Legal Landscape." In summary, here are the initial steps:

- Consult an Estate Attorney: Seek guidance from an experienced estate attorney to determine the appropriate probate option and whether you require legal representation throughout the process.

- Identify Estate Assets and Debts: Compile a comprehensive list of all assets and debts associated with the estate to facilitate the probate proceedings.

- Gather Names and Addresses: Ensure you have the names and addresses of anyone considered an heir "at law." These individuals will need to be notified of the petition to appoint a Personal Representative. Typically, if you are the surviving spouse, these heirs may include the deceased's children. If there are no children, it may involve their siblings or parents.

Coping with Grief While Managing the Details: Strategies for Support

While handling the practical aspects of managing a loved one's affairs, you will be simultaneously going through your own grieving process. Here are some considerations to assist you during this challenging time:

- Lean on Professionals (Attorneys, Accountants): While you may be capable of managing many details, you might find that it becomes an additional burden and emotionally challenging. This is where professionals can be invaluable. Seek their guidance and expertise to help navigate complex legal and financial matters.

- Seek Support from Your Network: Reach out to friends, family, or consider grief counseling to receive both emotional support and assistance in delegating tasks. Many people who also cared for the deceased may be eager to contribute in meaningful ways, lightening your load.

- Prioritize Self-Care and Well-Being: In addition to helping others process their grief, you may find yourself overwhelmed by your own emotions. It's essential to prioritize self-care and well-being. Carve out the necessary time for yourself without hesitation; your family and friends will understand and support your needs.

Need Help Understanding What to Do After the Death of a Loved One?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need.

Meet Our Estate Planning and Probate Lawyers

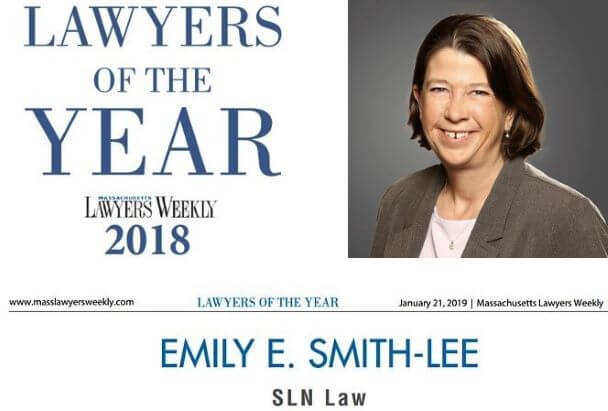

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

We understand the emotional and practical challenges that come with the loss of a loved one. We're here to help you with the legal aspects while you do what you need for emotional support and self-care. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.