Dying Without a Will in Massachusetts

Understanding the Consequences of Dying Without a Will in MassachusettsIf you've ever wondered what occurs when you don't have a will in Massachusetts, you're not alone. Many people hesitate to address this critical question, but it holds significant importance.

If you don't take the initiative to create an estate plan and you pass away without a will, Massachusetts estate law steps in with what's known as "intestate succession." This process will determine how your assets are distributed, typically to certain family members. However, it often doesn't align with your specific wishes. Without a comprehensive estate plan, your family will also face a more complex and time-consuming court process for asset distribution. Additionally, you'll miss out on opportunities to minimize or avoid estate taxes. |

We're Here to Help.OR

|

In the absence of a will, Massachusetts intestate succession laws dictate the distribution of your estate. This includes everything except assets like life insurance and jointly owned real estate, which bypass probate.

Generally, if you're married and have no children from another relationship, your assets will go to your surviving spouse. If there's no spouse or children, the distribution proceeds to your closest family members, starting with your parents, then siblings or their descendants. In rare cases with no living parents, siblings, or their children, the court considers cousins.

Generally, if you're married and have no children from another relationship, your assets will go to your surviving spouse. If there's no spouse or children, the distribution proceeds to your closest family members, starting with your parents, then siblings or their descendants. In rare cases with no living parents, siblings, or their children, the court considers cousins.

Who Inherits When There Is No Will?

What Happens to My Child if I Die Without a Will?

If you have minor children and die without a will, the other parent will become their sole legal guardian. If both parents are absent, the court must appoint a guardian, a process that can be time-consuming, expensive, and potentially lead to disputes.

Moreover, if your minor children inherit assets, a court process is required to establish a trust or custodian, as minors can't legally hold assets. Creating an estate plan allows you to name a guardian and set up trusts, simplifying the process and ensuring your children's well-being.

Moreover, if your minor children inherit assets, a court process is required to establish a trust or custodian, as minors can't legally hold assets. Creating an estate plan allows you to name a guardian and set up trusts, simplifying the process and ensuring your children's well-being.

Probate Without a Will

A will alone doesn't eliminate the need for probate, but it does make a difference. Whether you have a will or not, the probate process serves three key purposes: appointing a personal representative, determining estate assets, and distributing those assets. Having a will that clearly identifies your personal representative streamlines the appointment process. It also offers the opportunity to discuss asset details with family members and create a memorandum for your representative. Without a will, distribution adheres strictly to intestacy laws, potentially causing delays, conflicts, and confusion.

Estate Tax Without a Will

Failing to create an estate plan may result in missed opportunities to minimize or avoid estate taxes in Massachusetts. Your taxable estate includes assets like retirement funds, life insurance, and real estate, even if they pass automatically. Exceeding the $2 million threshold can lead to substantial estate tax liability. By working with an estate planning attorney to combine wills, trusts, and gift strategies, you can capitalize on tax exemptions to protect your family from unnecessary costs.

In summary, creating a comprehensive estate plan is crucial to ensure your assets are distributed as you wish, minimize legal complications, and protect your family from potential tax burdens. Don't leave these critical decisions to chance—consult with an estate planning professional to safeguard your legacy.

In summary, creating a comprehensive estate plan is crucial to ensure your assets are distributed as you wish, minimize legal complications, and protect your family from potential tax burdens. Don't leave these critical decisions to chance—consult with an estate planning professional to safeguard your legacy.

Questions About What Happens if Someone Dies Without a Will?

Schedule a free informational callback from a member of our team to learn more about how we can help you get started on the estate plan that is right for you or understand how to proceed if a loved one has died without a will.

Meet Our Estate Planning Lawyers

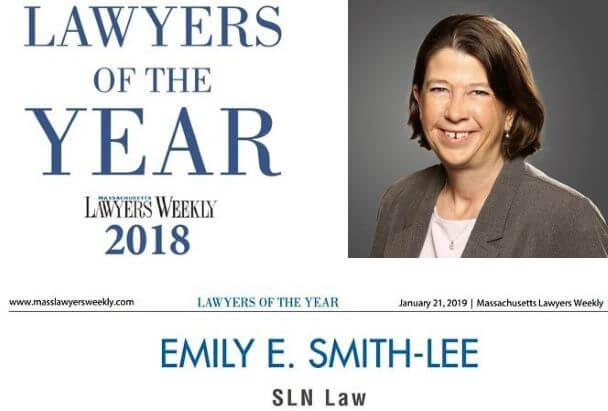

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

We are ready to help you put a comprehensive plan in place that meets all of your needs and your family's needs. We also know how hard it can be to get started, and do our best to make this process as easy as possible for you. You can use the button below to schedule a call back from a member of our team, or give us a call at 781-784-2322.