Estate Planning Considerations As You Approach Retirement

A New Chapter in Your Estate PlanningYour sixties and seventies mark a significant stage in your life, one that requires thoughtful estate planning to secure your financial future and preserve your legacy. Here are essential estate planning considerations for this phase.

|

We're Here to Help.OR

|

Asset Protection and Long Term Care

As you age, planning for long-term care becomes increasingly important. Healthcare costs can escalate rapidly, and it's crucial to safeguard your assets while ensuring you receive the necessary care. One effective tool for achieving this is an Asset Protection Trust.

An Asset Protection Trust is an irrevocable trust that allows you to transfer assets out of your name and into the trust. This protects these assets from being counted against you when determining Medicaid eligibility for long-term care.

It's important to be aware of the "look-back" period associated with Medicaid eligibility, which spans five years. Asset transfers made within this period may result in penalties when applying for Medicaid. To maximize the benefits of an Asset Protection Trust, establish it well in advance, ideally when you're in good health and don't anticipate needing long-term care soon.

An Asset Protection Trust is an irrevocable trust that allows you to transfer assets out of your name and into the trust. This protects these assets from being counted against you when determining Medicaid eligibility for long-term care.

It's important to be aware of the "look-back" period associated with Medicaid eligibility, which spans five years. Asset transfers made within this period may result in penalties when applying for Medicaid. To maximize the benefits of an Asset Protection Trust, establish it well in advance, ideally when you're in good health and don't anticipate needing long-term care soon.

Annual Giving Strategy

Another consideration in your sixties and seventies is estate tax planning. Depending on your assets, it may be time to explore strategies to minimize estate taxes. One such strategy is an Annual Giving Strategy, where you systematically gift assets to reduce your taxable estate while providing support to your loved ones.

This approach allows you to enjoy the satisfaction of assisting family members during your lifetime while minimizing the tax burden on your estate.

This approach allows you to enjoy the satisfaction of assisting family members during your lifetime while minimizing the tax burden on your estate.

Review Health Care Proxy and Power of Attorney

With the passage of time, your health care preferences and financial decisions may evolve. Therefore, it's crucial to review and update your Health Care Proxy and Power of Attorney documents. Ensure that these documents still accurately reflect your wishes and consider the availability and suitability of the individuals named in them.

Family Discussions

In your sixties and seventies, it's an ideal time to initiate conversations with your family about your estate plan. Discuss the location of your important documents, your wishes for medical decisions, and who has been designated for various roles in your plan. Open and honest communication can provide your loved ones with clarity, reduce potential confusion, and ensure your wishes are respected.

Need Help Creating or Updating an Estate Plan?

Schedule a free informational callback from a member of our team to learn more about how we can help you get started on the estate plan that is right for you.

Meet Our Estate Planning Lawyers

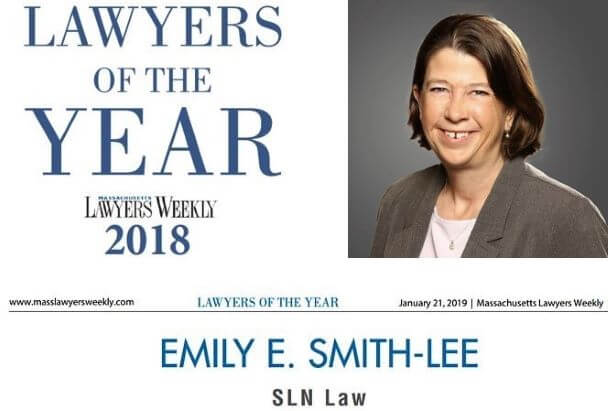

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Our experienced estate planning experts are here to guide you through the complexities of estate planning in your sixties and seventies, ensuring your financial future and family's well-being are secured. You can start by using the button below to schedule a free information call, or simply give us a call at 781-784-2322.