Crafting Your Estate Plan: 5 Simple Steps to Peace of Mind

Creating Your Estate Plan in 5 Simple StepsWelcome to the world of estate planning, where securing your family's future is easier than you might think. While the idea of estate planning can be daunting, the process itself is far less intimidating. We've outlined five straightforward steps to guide you from contemplating the future to having a solid plan in place, protecting your loved ones. Don't stress about having all the answers right away—our role is to assist you in navigating your choices and determining what's essential in crafting your plan. Explore these five simple steps below, and when you're ready, reach out to us to get started!

|

We're Here to Help.OR

|

Step One: Set Up Your Free Consultation

We're flexible with our consultations; whether you prefer in-person meetings or the convenience of phone or video conferences, we've got you covered. Typically, this initial consultation takes around 30-45 minutes of your time. During this conversation, you will meet with one of our consultants, whose job it is to understand your concerns, questions, assets, and goals, and talk to you about how we might be able to help.

Think of the consultation as a conversation where you share your information and concerns with us. You do not need to invest much, if any, time to prepare for it.

Think of the consultation as a conversation where you share your information and concerns with us. You do not need to invest much, if any, time to prepare for it.

Step Two: Meet With the Attorney and Select Your Options

If you decide to enlist our help with your plan, the next step is a meeting with one of our estate planning attorneys. They will have access to all of the information you provided in the consultation, and will be prepared to walk you through the different options available for your estate planning documents. Typically, a comprehensive estate plan for most families includes a combination of wills, trusts, a durable power of attorney, and a health care proxy. You can explore essential estate planning documents for various stages of life to understand what most people need.

At this meeting, the attorney will provide recommendations for your comprehensive estate plan. We can fine-tune the details later, such as naming a guardian for your minor children (if applicable), appointing a Personal Representative (formerly known as an Executor), and specifying asset distribution. At this stage, we'll focus on explaining the structures you can choose from to assemble your plan. We'll be there to answer any questions you have and address any concerns.

At this meeting, the attorney will provide recommendations for your comprehensive estate plan. We can fine-tune the details later, such as naming a guardian for your minor children (if applicable), appointing a Personal Representative (formerly known as an Executor), and specifying asset distribution. At this stage, we'll focus on explaining the structures you can choose from to assemble your plan. We'll be there to answer any questions you have and address any concerns.

Step Three: Review Your Drafts

After you have selected a plan, our estate planning lawyers will take the information you've provided and prepare the documents you've selected. You'll receive draft versions of your wills and trusts for your review. This is the point where we may need additional details, such as the names of your chosen Personal Representative or guardian, specific bequests, and more.

By this stage, most of the heavy lifting is complete. As you review your documents, you'll have the opportunity to speak with our lawyers if you have questions, concerns, or any changes you'd like to make.

By this stage, most of the heavy lifting is complete. As you review your documents, you'll have the opportunity to speak with our lawyers if you have questions, concerns, or any changes you'd like to make.

Step Four: Sign Your Documents

We'll schedule a final appointment for you to sign the documents. We'll provide the necessary notary and witnesses and guide you through the signing process to ensure all technical requirements are met, making your documents legally valid. Your only task is to attend the appointment, and you'll leave with your comprehensive estate plan in hand.

If reaching our offices is challenging for any reason, we can arrange to come to you with the documents and a notary public. All you'll need to do is ensure two adults who are not named in your will are available to witness the signatures.

If reaching our offices is challenging for any reason, we can arrange to come to you with the documents and a notary public. All you'll need to do is ensure two adults who are not named in your will are available to witness the signatures.

Step Five: Safeguard Your Estate Planning Documents

While we'll maintain both hard and electronic copies of your documents, your original signed wills and trusts should be securely stored. Ensure your chosen Personal Representative knows their location. Options for safe storage include a bank's safe deposit box, a fireproof home safe (with the key or combination noted in a location known to a family member), or sending a copy of instructions on accessing the documents to your Personal Representative.

If your plan incorporates a living trust, ensure anyone you've named as a trustee or successor trustee is aware of the document and has a copy. The same applies to individuals you've designated as health care agents or alternates.

Remember, if your family can't locate your estate planning documents, they may not even know you've left a will in the first place.

If your plan incorporates a living trust, ensure anyone you've named as a trustee or successor trustee is aware of the document and has a copy. The same applies to individuals you've designated as health care agents or alternates.

Remember, if your family can't locate your estate planning documents, they may not even know you've left a will in the first place.

That's It-You're All Set!

With these five simple steps, you'll have an effective estate plan in place, providing you and your loved ones with peace of mind for the future.

Need Help Understanding What it Looks Like to Get Started on an Estate Plan?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Meet Our Estate Planning Lawyers

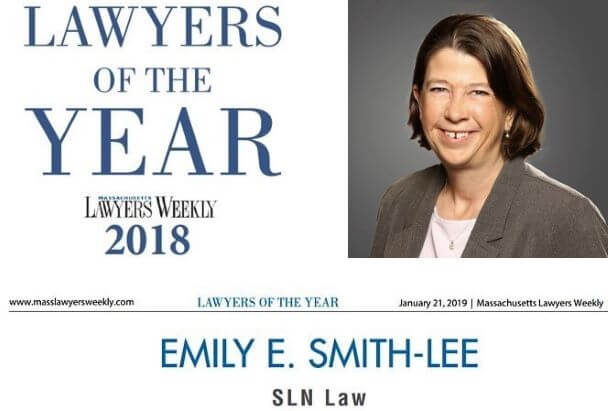

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

At slnlaw, we're here to guide you through the estate planning process with expertise and care. Our experienced team will assist you in setting up a comprehensive estate plan, including wills, trusts, durable powers of attorney, and health care proxies. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.