Estate Planning Considerations for Blended or Non Traditional Families

Estate Planning for Blended Families: Tailored Solutions for Complex DynamicsIn the realm of estate planning, blended families face unique challenges that necessitate thoughtful and tailored solutions. While a comprehensive estate plan benefits all families, it becomes even more critical in blended family scenarios. Explore the specific considerations that are vital to ensure your family members are cared for according to your wishes

|

We're Here to Help.OR

|

Navigating Special Considerations for Blended Families: Inheritance

In blended families, where children belong to both spouses and previous relationships, traditional legal assumptions may not align with your family's dynamics. It's essential to address specific concerns, such as:

Distribution of Assets: If you pass away without a will, Massachusetts law may divide your assets, giving a portion to your surviving spouse and the rest to your children. However, this distribution may not match your wishes.

Stepchildren Considerations: The law may not provide for your stepchildren in the way that you and your spouse want. Therefore, it's crucial to plan for their financial well-being.

Distribution of Assets: If you pass away without a will, Massachusetts law may divide your assets, giving a portion to your surviving spouse and the rest to your children. However, this distribution may not match your wishes.

Stepchildren Considerations: The law may not provide for your stepchildren in the way that you and your spouse want. Therefore, it's crucial to plan for their financial well-being.

Special Considerations for Blended Families: Your Incapacity

In estate planning, preparations for potential incapacitation are equally vital. Two essential documents to consider are:

Health Care Proxy and Durable Power of Attorney: Typically, spouses grant these responsibilities to each other, with adult children named as alternates. However, in blended families, especially when remarrying after your children have grown, determining decision-makers can be more complex. Clarity in these documents is essential to avoid conflicts during a crisis.

Health Care Proxy and Durable Power of Attorney: Typically, spouses grant these responsibilities to each other, with adult children named as alternates. However, in blended families, especially when remarrying after your children have grown, determining decision-makers can be more complex. Clarity in these documents is essential to avoid conflicts during a crisis.

Special Considerations for Blended Families: Planning for Long-Term Care

The cost of long-term care can erode family assets, leading to stress and conflict. In blended families, this issue is particularly sensitive, as one spouse may have children from a previous marriage. To protect your legacy, consider:

Medicaid Trust: For anyone who may need help with assisted living within 10 years (either based on your age or health status), a Medicaid trust can be a valuable tool. It allows you to preserve a portion of your assets while securing Medicaid assistance for long-term care if needed. This proactive step can prevent the depletion of your intended legacy.

Medicaid Trust: For anyone who may need help with assisted living within 10 years (either based on your age or health status), a Medicaid trust can be a valuable tool. It allows you to preserve a portion of your assets while securing Medicaid assistance for long-term care if needed. This proactive step can prevent the depletion of your intended legacy.

Essential Estate Planning Documents for Blended Families

To address the unique challenges of blended families, ensure that you have the following estate planning documents in place:

- Wills: Both you and your spouse should have wills that clearly outline your wishes for asset distribution, considering all family members, including stepchildren.

- Health Care Proxy and Durable Power of Attorney: These documents provide clarity and avoid uncertainty in decision-making during times of incapacitation.

- Trusts: Consider creating trusts that balance the needs of your spouse and your children. For example, a trust can provide income to the surviving spouse during their lifetime while preserving the core assets for your intended beneficiaries.

- Medicaid Trust: If you or your spouse are 65 or older, a Medicaid trust can protect assets from long-term care costs, ensuring your family's financial well-being.

In summary, estate planning for blended families requires a thoughtful and customized approach to address unique dynamics. By carefully considering inheritance, incapacity, and long-term care, and by having the right estate planning documents in place, you can protect your family's future and ensure your wishes are honored.

Need Help Understanding What You Need in Your Estate Plan?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Meet Our Estate Planning Lawyers

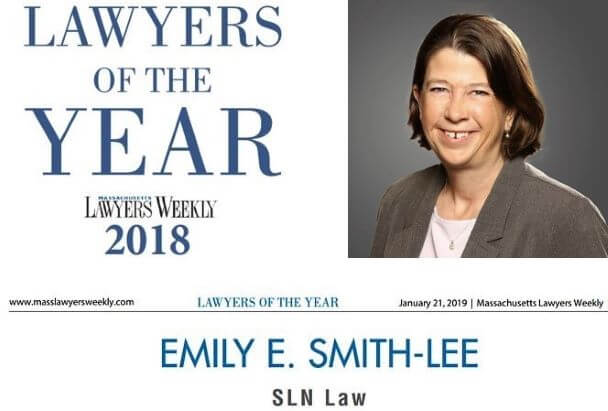

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Our experienced estate planning attorneys understand the complexities that blended families face. We work closely with you to craft a customized estate plan that aligns with your unique family dynamics and aspirations. Whether you need to ensure fair inheritance, designate decision-makers for potential incapacity, or safeguard your assets from long-term care costs, our team has the expertise to guide you. We'll assist you in creating wills, trusts, and other essential documents that provide clarity and protection, giving you peace of mind that your blended family's future is secure. With our assistance, you can navigate the intricacies of estate planning with confidence. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.