Massachusetts Estate Planning Solutions

What Our Estate Planning Attorneys Can Do For YouAt slnlaw, our team of experienced estate planning attorneys brings a wealth of knowledge and dedication to serving individuals and families of all backgrounds and income levels. With combined decades of legal expertise, our attorneys have successfully helped numerous clients navigate the complexities of estate planning, ensuring their wishes are understood and their legacies are protected.

From guiding clients through the creation of comprehensive estate plans to providing compassionate support during times of transition, our team is committed to delivering personalized solutions tailored to each client's unique needs and circumstances. Whether you're planning for the future, protecting your loved ones, or navigating the probate process, you can trust our team to provide expert guidance and unwavering support every step of the way. Our estate planning services include:

What's even better is that we offer the convenience of remote consultations and services for most of the estate planning process. This means you can take care of everything you need from the comfort of your own home, with the exception of the final signing. Don't let uncertainty about the future hold you back. Take the first step towards securing your family's well-being by reaching out to our estate planning experts today. Your Estate Planning ResourcesWe know you come into this with questions. We are happy to speak with you about them- you should also know we have assembled a vast amount of information on this site to help you understand the basics of estate planning, and some deeper details on selected topics. You can start with our estate planning frequently asked questions, or our guide to estate planning content to see if you can find what you are looking for there.

|

We're Here to Help.OR

|

Need Help Getting Started on Your Estate Plan?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Meet Our Estate Planning Lawyers

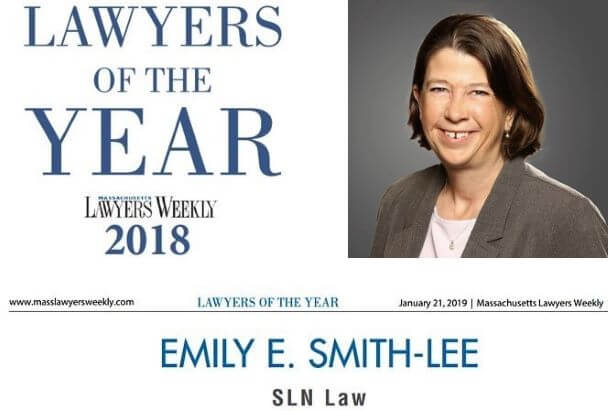

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

We understand how personal this decision is. We also understand that individuals and families all have unique needs and wishes- we are not here to judge those wishes, but simply to help make sure they come to pass. You can use the button below to schedule a free information call, or give us a call at (781) 784-2322.

|

Jenna Ordway

Rated by Super Lawyers loading ... |

Emily Smith-Lee Rated by Super Lawyers loading ... |