Understanding Civil Lawsuit Settlements: A Comprehensive Guide

Navigating Civil Lawsuit Settlements EffectivelyWelcome to our comprehensive guide on civil lawsuit settlements. At various stages of your legal journey, you'll likely encounter the need to evaluate and potentially accept a settlement offer. While your attorney will provide guidance and recommendations, the final decision rests with you.

Assessing Your Case's ValueDetermining the worth of your case hinges on two critical factors: the potential damages you could recover in a court victory and the likelihood of winning those damages.

Your lawyer should be able to provide an estimate of what you might expect if your case goes to trial. This estimation depends on the nature of your claims and the extent of the compensable damages incurred. However, the heart of settlement negotiations often lies in your chances of success. Some legal claims are challenging to prove, and the opposing party may possess evidence detrimental to your case. Your attorney will assess the probability of success, and the other side's attorney will have their own perspective. Typically, your lawyer will be more optimistic about your chances. To simplify, let's consider an example. If your damages amount to $100,000 and your attorney believes there's a 65% chance of success, while the other side sees it as 25%, the settlement value typically falls between $25,000 and $65,000. There are, of course, other considerations and it is not just math. A plaintiff may need the money quickly and be willing to accept less for a fast payment. A defendant might think the settlement value is very low, but be considering their own legal fees as part of their risk. Either side may have reasons other than money that they are engaged in the dispute. The above math, however, should at least give you a framework for how lawyers think about settlement value on both sides. Considerations: Taxes and Attorneys' FeesWhen contemplating a settlement offer, it's crucial to clarify how much of the settlement amount you'll retain. Various factors come into play:

Is the Settlement Taxable?In most civil cases, the settlement payment qualifies as taxable income. In employment-related cases, the portion attributed to lost wages undergoes payroll processing, with income tax withholding similar to regular paychecks.

Other components of the settlement, such as compensation for emotional distress or business damages, may not undergo withholding. Nevertheless, you'll receive a Form 1099 the following year. It's advisable, especially for substantial amounts, to consult a tax advisor to understand the taxation implications. Keep in mind that, with a few exceptions, the income from civil case settlements is generally taxable. To put this in perspective, consider that lost wages or damages to your business would have been subject to taxation if you hadn't faced job termination or business issues initially. While taxation isn't within your or the other party's control, understanding its impact is crucial when considering a settlement. |

We're Here to Help.OR

|

Questions About Settlement in a Civil Lawsuit?

Our Solutions Roadmap is a quick and easy way to share the details of what you are facing and receive preliminary feedback from a member of our team. Use the button below to get started- it is 100% confidential and 100% free.

Attorneys Fees

If you're billed hourly by your attorney, you'll already be aware of your incurred expenses, which should factor into your calculations. For those on a contingent fee basis, you'll need to deduct the agreed-upon amount or percentage from the total settlement offer.

In many cases, particularly in matters like discrimination, harassment, or wage and hour disputes, if you win, the opposing side may be responsible for your attorney fees. Although settlement offers typically don't separate damages from fees, this can be a valuable negotiation point for your lawyer.

In many cases, particularly in matters like discrimination, harassment, or wage and hour disputes, if you win, the opposing side may be responsible for your attorney fees. Although settlement offers typically don't separate damages from fees, this can be a valuable negotiation point for your lawyer.

Calculating Your Net Settlement Amount: The Bottom Line

Taxes, attorneys fees and out of pocket costs should all be considered in evaluating the total settlement amount presented. Using the prior example, assume the settlement value is $50,000. If you are on a contingent fee engagement at 33%, $16,500 of that will go to your attorneys, leaving a net of $33,500. Assuming a 30% withholding rate, the net check to you would be $23,450.

Why Opt for a Settlement?

It's important to note that over 97% of civil cases are settled before reaching trial. This high settlement rate is due to several reasons, including:

- Uncertainty of Trial Outcome: Trials are unpredictable, with potential outcomes varying widely. While you could recover more than a settlement offer, there's also a chance of recovering nothing or receiving lower damages than expected.

- Time Considerations: Legal proceedings, including discovery and trial preparation, can be time-consuming. Court backlogs, particularly post-pandemic, have further delayed the judgment process.

- Closure: Many individuals prefer to put legal disputes behind them. Lawsuits often arise from painful experiences, and achieving a settlement allows parties to move forward with their lives.

Meet Our Trial Attorneys

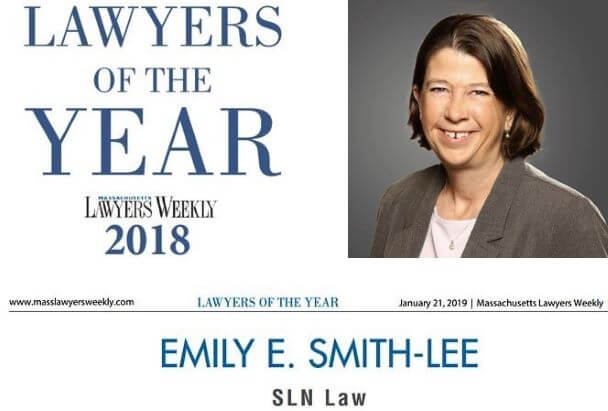

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years, with a focus on complex business litigation. In 2009, she started the firm that became slnlaw. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year for a precedent-setting victory at the Massachusetts Supreme Judicial Court. She has written a book on employment law: Rules of the Road, What You Need to Know About Employment Laws in Massachusetts, and helped thousands of clients with business and employment disputes. Emily has handled cases at every level of the state system, in the federal trial court, and before the First Circuit Court of Appeals.

Elijah Bresley: Eli is a 2014 graduate of Seton Hall Law school, and has worked with slnlaw since 2020. He previously worked for a boutique employment law firm outside of Boston, and then for the Labor and Employment department of a large Boston firm. He also spent a year clerking for the judges of the Superior Court in Hartford, Connecticut. Eli has successfully defended numerous employers in the MCAD, and litigated other business and employment disputes throughout the state court system and in the federal trial court.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has litigated both plaintiff and defendant cases in the state court system, MCAD, and the federal trial court.

How We Can Help

If you are unsure whether you should accept a settlement offer, or simply need help understanding your claims and what they might be worth, we can help. You can use the button below to schedule a call back from a member of our team, or give us a call at 781-784-2322.

|

Emily Smith-Lee Rated by Super Lawyers loading ... |

Jenna Ordway

Rated by Super Lawyers loading ... |