Estate Planning for Young Adults: Securing Your Future

You Are Not Too Young for an Estate PlanWhen you're in your late teens or early twenties, estate planning may be one of the last things on your mind. After all, you're just getting started in life, and the idea of planning for your future, especially for events you hope are many years away, can seem daunting. However, estate planning for young adults is more important than you might think. It's about safeguarding your interests, ensuring your wishes are respected, and preparing for the unexpected.

|

We're Here to Help.OR

|

Why Young Adults Need Estate Planning

- Accidents Happen: No one plans for accidents or unexpected health issues, but they can occur at any age. Having an estate plan in place ensures that your wishes are followed, even if you cannot communicate them.

- Digital Assets: In the digital age, your online presence is significant. A will can help manage your digital assets, ensuring that your online accounts and information are handled as you wish.

- Medical Decisions: Your health care proxy ensures that someone you trust makes medical decisions for you if you cannot. It provides clarity and peace of mind for both you and your family.

The Fundamental Documents for Young Adults

Estate planning doesn't have to be complex, especially when you're just starting out. Here are the three fundamental documents you should consider:

1. Will: A will is often considered the cornerstone of any estate plan. It's a legal document that allows you to determine how your assets will be distributed after your passing. Even if you don't currently own substantial assets, a will provides a clear roadmap for what you do have. This can include personal belongings, savings, or even your digital assets.

While you may not have significant financial resources at this stage, a will ensures that your wishes are followed. It allows you to specify who should receive your belongings, ensuring they go to the people or organizations you care about. Additionally, a will can address your digital footprint, which includes your social media accounts, emails, and other online assets. Without clear instructions in your will, your digital presence may become challenging for your loved ones to manage.

2. Health Care Proxy: A health care proxy is a vital document that designates someone you trust to make medical decisions on your behalf if you are unable to do so. Accidents and unforeseen health issues can happen at any age, and having a designated individual who knows your preferences and values can be essential. This document ensures that your wishes are respected when it comes to medical treatment and care.

Your health care proxy can make decisions about treatments, surgeries, and other medical interventions based on your instructions and values. It provides peace of mind for you and your loved ones, knowing that your medical care is in capable hands.

3. Power of Attorney: A durable power of attorney is a document that grants someone you trust the authority to manage your financial affairs if you become unable to do so. This can include handling your bank accounts, paying bills, and making legal and financial decisions on your behalf. While you may be perfectly capable of managing your finances now, unforeseen circumstances, such as accidents or illnesses, can change that.

Having a durable power of attorney in place ensures that someone you choose can step in and manage your financial matters seamlessly. It prevents potential financial difficulties and ensures that your interests are protected.

1. Will: A will is often considered the cornerstone of any estate plan. It's a legal document that allows you to determine how your assets will be distributed after your passing. Even if you don't currently own substantial assets, a will provides a clear roadmap for what you do have. This can include personal belongings, savings, or even your digital assets.

While you may not have significant financial resources at this stage, a will ensures that your wishes are followed. It allows you to specify who should receive your belongings, ensuring they go to the people or organizations you care about. Additionally, a will can address your digital footprint, which includes your social media accounts, emails, and other online assets. Without clear instructions in your will, your digital presence may become challenging for your loved ones to manage.

2. Health Care Proxy: A health care proxy is a vital document that designates someone you trust to make medical decisions on your behalf if you are unable to do so. Accidents and unforeseen health issues can happen at any age, and having a designated individual who knows your preferences and values can be essential. This document ensures that your wishes are respected when it comes to medical treatment and care.

Your health care proxy can make decisions about treatments, surgeries, and other medical interventions based on your instructions and values. It provides peace of mind for you and your loved ones, knowing that your medical care is in capable hands.

3. Power of Attorney: A durable power of attorney is a document that grants someone you trust the authority to manage your financial affairs if you become unable to do so. This can include handling your bank accounts, paying bills, and making legal and financial decisions on your behalf. While you may be perfectly capable of managing your finances now, unforeseen circumstances, such as accidents or illnesses, can change that.

Having a durable power of attorney in place ensures that someone you choose can step in and manage your financial matters seamlessly. It prevents potential financial difficulties and ensures that your interests are protected.

Conclusion

Estate planning for young adults is not about wealth; it's about securing your future and ensuring that your wishes are respected. These fundamental documents—your will, health care proxy, and power of attorney—provide a foundation for your estate plan. They offer peace of mind and protection, allowing you to focus on building your life and pursuing your goals with confidence.

Need Help Understanding What You Need to Achieve Your Estate Planning Goals?

Schedule a free informational callback from a member of our team to learn more about how we can help you get started on the estate plan that is right for you.

Meet Our Estate Planning Lawyers

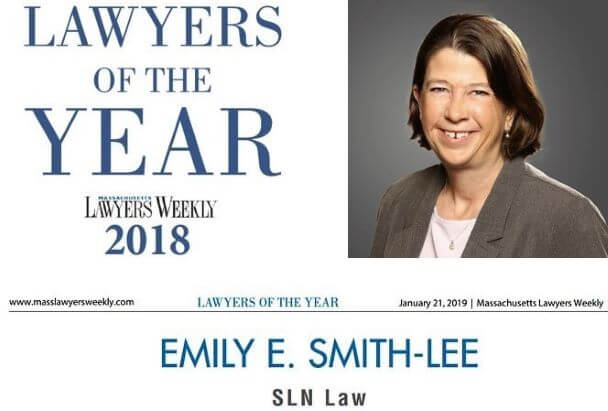

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Our experienced estate planning team can guide you through the process, ensuring your wishes are protected, and your future is secure. You can start by using the button below to schedule a free information call, or simply give us a call at 781-784-2322.