What is Mental Capacity to Make or Change a Will?

The Legal Standard for Competence to Sign a WillIf you have aging parents or loved ones who need to make or change their estate plan, it is important to understand the legal definition of "mental capacity" in this context.

It is actually quite limited. A person need only understand the extent of their property, the people who are their natural heirs, and the consequences of signing a will. This means even people who are unable to manage their own affairs due to dementia could be legally competent to update their estate plan for quite a while, so long as they know the nature of what they own, who their family members are, and that the estate planning documents will dictate who gets those assets. It is also important to remember that the person only needs mental capacity at the moment he or she signs the will. Someone with a mental disorder or dementia may have lucid moments even if there are times they do not meet the test. At those times, they may have the legally required state of mind. If there is any doubt, this should be discussed with their estate planning attorney. The attorney may ask to meet separately with your parent(s) in order to make their own assessment of competence to sign the documents. They may also recommend recording the conversation in case it is ever needed as evidence. Learn more here about mental capacity to make a will in Massachusetts. |

We're Here to Help.OR

|

Need Help Understanding Whether a Loved One is Legally Competent to Make a Will?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Meet Our Estate Planning and Probate Lawyers

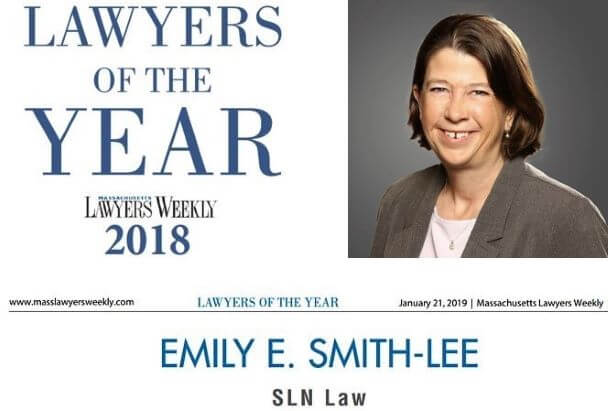

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Estate planning is often a difficult, yet critical, topic. What will happen to your assets when you are gone, how much of your legacy can be protected against estate taxes or other costs like the costs of long term care, and how to spare your family the time and cost of probate court are some of the most common questions.

There are additional questions people often have, like who you want to have medical and financial decision making power if you are incapacitated, how to handle complex family structures, estate planning considerations for a child with disabilities or special needs, how to take care of a surviving spouse and still ensure key assets are ultimately available for your children, and more.

Finally, you may find yourself needing to understand a loved one's estate plan, either when you are dealing with the aftermath of their passing or helping aging parents with their affairs. Understanding the scope of their durable power of attorney and health care proxy can be critical for you at this stage. It is also in many cases a window of opportunity for them to review their plans and make sure everything is set up to go smoothly after they are gone.

We're here to help you create the documents you need to achieve your goals, whatever they are. Whether you need a comprehensive estate planning package (a will, a trust, a durable power of attorney and a health care proxy) or something simpler, our experienced estate planning team can help you make a plan that meets your goals, protects your legacy, and gives you peace of mind.

You can use the button below to schedule a free information call with a member of our team and learn how to get started, or simply give us a call at (781) 784-2322.

There are additional questions people often have, like who you want to have medical and financial decision making power if you are incapacitated, how to handle complex family structures, estate planning considerations for a child with disabilities or special needs, how to take care of a surviving spouse and still ensure key assets are ultimately available for your children, and more.

Finally, you may find yourself needing to understand a loved one's estate plan, either when you are dealing with the aftermath of their passing or helping aging parents with their affairs. Understanding the scope of their durable power of attorney and health care proxy can be critical for you at this stage. It is also in many cases a window of opportunity for them to review their plans and make sure everything is set up to go smoothly after they are gone.

We're here to help you create the documents you need to achieve your goals, whatever they are. Whether you need a comprehensive estate planning package (a will, a trust, a durable power of attorney and a health care proxy) or something simpler, our experienced estate planning team can help you make a plan that meets your goals, protects your legacy, and gives you peace of mind.

You can use the button below to schedule a free information call with a member of our team and learn how to get started, or simply give us a call at (781) 784-2322.

|

Jenna Ordway

Rated by Super Lawyers loading ... |

Emily Smith-Lee Rated by Super Lawyers loading ... |