Estate Planning Considerations for a Non Citizen Spouse

Crafting a Thoughtful Estate Plan for Non-Citizen Spouses in MassachusettsEstate planning for couples in Massachusetts typically involves considerations such as asset protection and minimizing estate taxes. However, when one spouse is a non-citizen, navigating these financial intricacies becomes even more crucial.

The primary challenge lies in the unique rules governing estate taxes and spousal gifting in such cases. Unlike couples where both partners are U.S. citizens, unlimited gifting between spouses is not applicable when one is a non-citizen. This distinction necessitates a more meticulous approach to safeguarding your assets and ensuring your spouse's financial well-being. Understanding these distinctions and planning accordingly is essential to achieving your estate planning goals while adhering to the laws that pertain to non-citizen spouses. |

We're Here to Help.OR

|

GIfts Between Spouses

For couples with a non-citizen spouse, the annual gift limit is $155,000, unlike citizen spouses who can gift an unlimited amount. This can complicate matters, particularly regarding jointly owned property, where the non-citizen spouse's interest may be considered a taxable gift.

One Solution: A Qualified Domestic Trust ("QDOT")

For couples in this situation, a Qualified Domestic Trust or QDOT becomes essential. It requires a U.S. citizen trustee, and for assets exceeding $2 million, a U.S. bank or domestic corporation must serve as trustee. The QDOT can provide income to the non-citizen spouse, with principal distributions subject to estate tax withholding or hardship circumstances. Upon the non-citizen spouse's passing, trust assets are taxed as part of the first spouse's taxable estate.

Life Insurance Proceeds

Life insurance proceeds are part of your taxable estate, and careful planning is crucial. Naming the QDOT as the beneficiary on your life insurance policy can help avoid immediate taxation on the proceeds. However, if the beneficiary designation remains unchanged, the non-citizen spouse can choose to disclaim the proceeds, rolling them into a QDOT or receiving them directly, albeit with potential estate tax liability.

Alternatives to a QDOT

Federal law offers a "grace period" for the surviving spouse. If they become a U.S. citizen within nine months of the first spouse's death before filing the estate tax return, the estate will be treated as if both spouses were citizens at the time of death.

Tailoring Estate Plans for Non-Citizen Spouses: Navigating Tax Rules and Achieving Your Objectives

These estate tax rules exist not as anti-immigration policies but as mechanisms to ensure proper tax collection. Planning to minimize estate taxes is indeed feasible for couples with non-citizen spouses. The appropriate plan depends on your unique family situation and goals. If your spouse is pursuing U.S. citizenship, setting up a QDOT as a precaution is advisable. Keep in mind that there's still a nine-month grace period post your passing for your spouse to become a citizen. If your spouse doesn't plan to become a U.S. citizen, discussing the pros and cons of a QDOT is essential. Alternatively, you can pass assets to your spouse while considering estate tax liability, especially if your assets exceed $1 million (for Massachusetts estate tax). Our experienced estate planning attorneys can help tailor the right strategy for your specific needs and objectives.

Need Help Understanding What You Need in Your Estate Plan?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

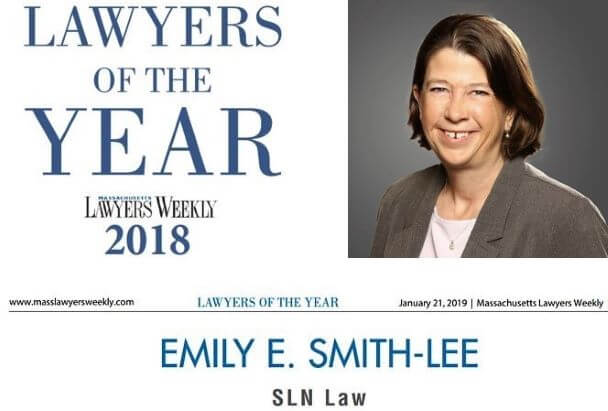

Meet Our Estate Planning Lawyers

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

Our seasoned estate planning attorneys are here to provide expert guidance and tailored strategies to address the unique challenges posed by having a non-citizen spouse in your estate planning. Whether you are considering a Qualified Domestic Trust (QDOT) or exploring alternative solutions, our team will work closely with you to create a comprehensive plan aligned with your family's specific needs and long-term objectives. With our assistance, you can ensure your assets are protected, your spouse is provided for, and your estate tax liability is minimized. Contact us today to secure your family's financial future. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.