Estate Planning for Young Families: Securing Your Loved Ones' Future

Securing Your Family's Future with Estate PlanningWhile your focus may be on raising children and building a bright future, it's equally important to plan for their financial security and well-being in the event of the unexpected.

|

We're Here to Help.OR

|

Why Estate Planning Matters for Young Families

Estate planning isn't just for the elderly or the wealthy; it's essential for young families as well. Here's why:

- Protecting Your Children: Estate planning ensures that your children are cared for by trusted guardians if both parents are unable to do so. It's a way to provide them with stability and a loving home. It is also a way to provde a clear roadmap for your family, so that if something happens to you there will be no delay in getting your children to the people you want them to be with.

- Financial Security: You've worked hard to provide for your family. Estate planning helps preserve your assets and ensures they are used to support your loved ones.

- Avoiding Probate: Proper planning can help your family avoid the time-consuming and costly probate process, ensuring a smoother transition of assets.

- Healthcare Decisions: Estate planning includes provisions for healthcare directives, allowing you to specify your medical preferences and who should make decisions on your behalf.

- Minimizing Taxes: Strategic estate planning can help reduce tax liabilities, leaving more for your family. Remember that the threshold for Massachusetts estate tax applies to anything over $2 million, which includes life insurance proceeds, the value of your home, and any other assets. While you are busy living your life and raising your children, your assets could easily reach and surpass this threshold.

Key Components of Estate Planning for Young Families

Wills and Trusts:

- A will specifies how your assets should be distributed and who will care for your children.

- Trusts can be set up to provide for your children's education, healthcare, and other needs.

- Choose trusted individuals to serve as guardians for your children.

- Ensure they share your values and parenting philosophies.

- Review and update beneficiary designations on insurance policies, retirement accounts, and investments.

- Consider life insurance to provide financial support for your family

- Prepare advance healthcare directives, including a durable power of attorney for healthcare.

- Specify your medical preferences and who should make decisions in case of incapacity.

- Document important information, such as account passwords and contact details for legal and financial advisors.

- Share this information with trusted family members.

Getting Started: Initiating Your Estate Plan

Estate planning may seem like a complex task, but taking the first steps now can provide peace of mind and secure your family's future. Here's a guide on how to get started:

1. Identify Your Goals:

2. Identify Your Assets:

3. Designate Beneficiaries:

4. Seek Professional Guidance:

1. Identify Your Goals:

- Family Protection: Determine how you want to protect your family in case of unexpected events, such as your incapacity or passing.

- Asset Distribution: Consider how you want your assets to be distributed among your loved ones.

2. Identify Your Assets:

- You do not neet a detailed inventory to get started on an estate plan- just a list of the major things you own and an approximate value.

3. Designate Beneficiaries:

- Update Accounts: Review and update beneficiary designations on life insurance policies, retirement accounts, and other financial assets.

- Specify Contingent Beneficiaries: Consider naming contingent beneficiaries in case your primary beneficiary predeceases you. Most young families name the spouse as the primary beneficiary and children as contingent beneficiaries, so you know these assets will pass to your family without needing to wait for Probate.

4. Seek Professional Guidance:

- Consult an Attorney: Enlist the services of an experienced estate planning attorney who specializes in the unique needs of young families. If you have taken the simple steps above, they should be ready to design a plan that meets your family's needs and goals.

- Financial Advisor: Work with a financial advisor to align your estate plan with your financial goals and investment strategies.

Need Help Getting Started With an Estate Plan?

Schedule a free informational callback from a member of our team to learn more about how we can help you get started on the estate plan that is right for you.

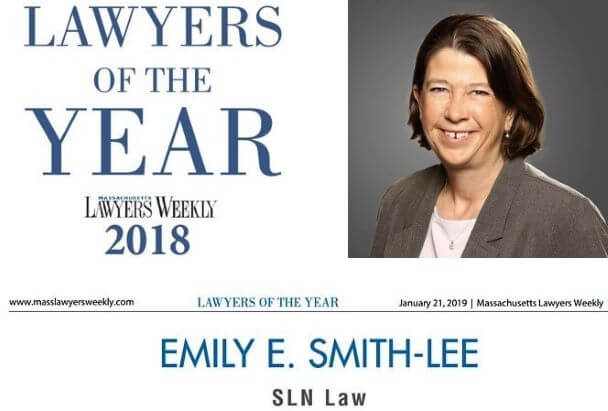

Meet Our Estate Planning Lawyers

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

At slnlaw, our experienced estate planning attorneys are here to assist young families in creating a solid estate plan that secures your family's future. We understand the unique needs of young families and can help you navigate the complexities of estate planning efficiently. You can start by using the button below to schedule a free information call, or simply give us a call at 781-784-2322.