Stop Procrastinating: Secure Your Family's Future with an Estate Plan

What's Stopping You From Creating an Estate Plan?Estate planning is a critical step towards safeguarding your family's future and ensuring that your assets are handled as per your wishes. Yet, many individuals delay or neglect this essential task, despite the potential consequences. In this guide, we'll explore the common reasons people put it off, as well as the very real risks you face if you continue to do so.

|

We're Here to Help.OR

|

Why You Don't Have an Estate Plan

While every situation is unique, there are common reasons people hesitate to create an estate plan:

1. Perceived Lack of Urgency:

1. Perceived Lack of Urgency:

- Some individuals believe that estate planning is unnecessary when they are young and healthy. However, addressing it early can prevent family crises later on, especially for blended families.

- Estate planning isn't exclusive to the wealthy. Regardless of your financial status, you have assets and desires for their distribution. If you have minor children, a plan is crucial.

- Cost considerations often deter individuals from estate planning. Yet, the expenses of probate without a will and potential estate taxes can far outweigh the cost of setting up a plan.

- Busy schedules can lead to procrastination. The good news is that once you take the initial step to hire an attorney, most of the work is handled by professionals.

- Choosing an estate planning lawyer is a significant decision. While it may feel overwhelming, finding a trustworthy attorney is essential. Utilizing resources like Avvo.com and Google reviews can help you make an informed choice.

The Dangers of Procrastinating on Your Estate Plan

Procrastination is a common human tendency, and when it comes to estate planning, it's no different. However, understanding the potential dangers of procrastination is crucial to motivate action. Here's why delaying your estate plan can have costly and adverse consequences:

1. Family Uncertainty:

1. Family Uncertainty:

- Without a clear estate plan, your loved ones may be left in the dark about your wishes. This uncertainty can lead to confusion, disputes, and unnecessary stress during an already challenging time.

- When you pass away without a will (intestate), your assets typically go through the probate process. Probate can be time-consuming and costly, with fees that can range from 3% to 8% of the total estate value. These expenses are paid from your assets, reducing the inheritance for your heirs.

- Without a will or trust, your assets will be distributed according to state intestacy laws, which may not align with your desires. This can result in assets going to unintended beneficiaries or being divided in a way you wouldn't have chosen.

- If you have minor children, estate planning is crucial for naming a guardian to care for them in your absence. Without a plan, the court may appoint a guardian without considering your preferences.

- Depending on your estate's value, it may be subject to federal or state estate taxes. Proactive estate planning can help minimize or eliminate these tax burdens. Without a plan, your estate may incur unnecessary tax liabilities, reducing the inheritance for your heirs.

- Lack of clarity and guidance in your estate plan can lead to disagreements among family members. This can strain relationships and result in costly legal battles.

- Estate planning isn't just about distributing assets; it's about optimizing your legacy. Delaying your plan means missing opportunities to protect your assets, support charitable causes, or provide for future generations.

- Life is unpredictable. Unexpected accidents or illnesses can occur at any time. By procrastinating on estate planning, you risk leaving your loved ones unprepared in the event of an emergency.

Need Help Getting Started With an Estate Plan?

Schedule a free informational callback from a member of our team to learn more about how we can help you get started on the estate plan that is right for you.

Meet Our Estate Planning Lawyers

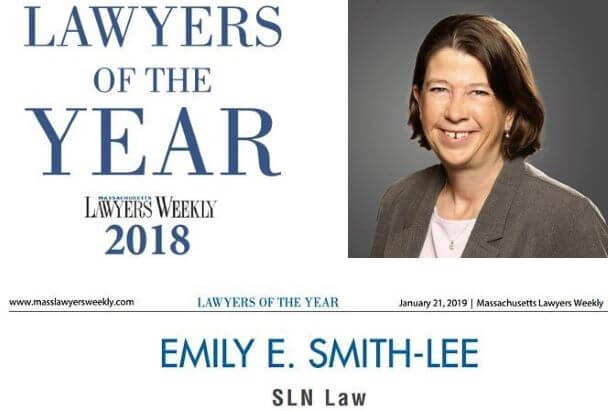

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

At slnlaw, we specialize in helping individuals overcome procrastination and create effective estate plans. Our experienced team is here to simplify the process and ensure your family's peace of mind. You can use the button below to schedule a free information call, or simply give us a call at 781-784-2322.