Estate Planning for Special Needs Children: Key Considerations

Special Needs Planning: The EssentialsParenting a special needs child presents unique challenges, and your estate plan should reflect these considerations. While it may seem daunting, rest assured that effective tools, such as wills and trusts, exist to address the specific needs of your family. Here, we outline the essential elements to discuss with your estate planning lawyer.

Special Needs Trust: Ensuring Financial SecurityYour special needs child may face limitations in generating income throughout their lifetime. Balancing the desire to treat all your children equally may necessitate allocating more resources to support your disabled beneficiary. Additionally, even if your child is legally competent, their ability to manage an inheritance effectively may be limited, making a trust a prudent choice.

To tailor your estate plan to your preferences, you'll likely need at least a will. If you want to ensure that someone you trust manages your child's assets after your passing, a combination of wills and trusts, including a special needs trust or supplemental needs trust, is essential. This also involves appointing a suitable trustee to oversee the assets your child inherits. Special Needs Trust: Safeguarding Benefit EligibilityMany individuals with special needs qualify for federal Supplemental Security Income (SSI) and other need-based government assistance programs. These programs are crucial for your child's ongoing financial stability, particularly when you and your spouse are no longer able to provide care. However, inheriting assets could jeopardize eligibility.

To strike the right balance, consider establishing a special needs trust to hold assets on behalf of your child. Ensure the trust document offers clear guidance for the trustee responsible for administering and managing the assets. Properly structured, the assets in this trust will not affect your child's eligibility for benefits. |

We're Here to Help.OR

|

Questions About a Beneficiary with Special Needs?

We have a FREE online workshop with one of our experienced estate planning attorneys to help give you the answers you need to get started on your road to peace of mind.

Guardians and Conservators: Securing Your Child's Future

If your child is a minor, your will should designate a guardian. However, even as your child reaches adulthood, they may still require a guardian and/or conservator. These roles may need to be defined more precisely to address what your child can manage independently and where they need assistance, such as financial matters.

While you or your surviving spouse may currently fulfill these roles, planning for the future is essential. Identify family members who can step in, ensuring a seamless transition for your child. To prepare the guardian, provide as much information as possible about your disabled child, including medical providers, preferences, and your aspirations for their future.

While you or your surviving spouse may currently fulfill these roles, planning for the future is essential. Identify family members who can step in, ensuring a seamless transition for your child. To prepare the guardian, provide as much information as possible about your disabled child, including medical providers, preferences, and your aspirations for their future.

In Summary: Essential Documents for Your Child's Protection

Your comprehensive estate plan should encompass:

- Wills designating guardians and/or conservators for your disabled child and any other minor children.

- Trusts to shield assets from estate taxes and potential long-term care costs for you and your spouse, including a special needs trust to protect your child's government benefit eligibility.

- Durable power of attorney for you and your spouse.

- Health care proxies for you, your spouse, and your special needs adult child, with identified alternates in case of unforeseen events.

- A list of your child's medical and service providers, along with brief service descriptions.

- A summary of your child's functional strengths and weaknesses, detailing their level of independence, areas requiring assistance, and common sources of frustration.

- A copy of your child's most recent Individualized Education Plan (IEP) or 504 plan if they are still attending school.

Meet Our Estate Planning Lawyers

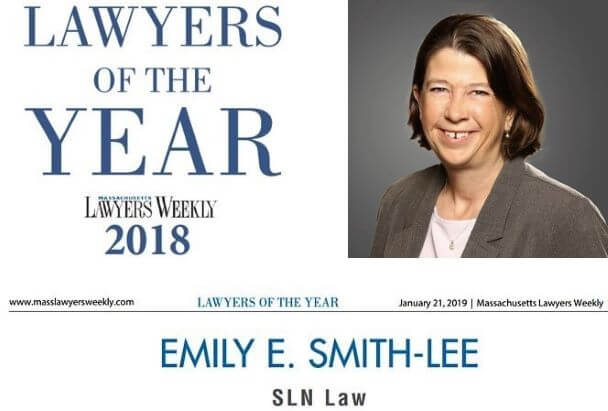

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.

How We Can Help

We are ready to help you put a comprehensive plan in place that meets all of your needs and your family's needs. We also know how hard it can be to get started, and do our best to make this process as easy as possible for you. You can use the button below to schedule a call back from a member of our team, or give us a call at 781-784-2322.