Why You're Richer Than You Think: Estate Taxes in Massachusetts

Understanding the $2 Million Threshold and How to Protect Your AssetsEveryone has an estate. It may not look like a sprawling mansion in the countryside, complete with a butler and a carriage driver, but in the eyes of Massachusetts law, if you have any assets to your name (even just a bank account), you have an estate.

It’s highly likely that your estate makes you richer than you think, and here’s why: your estate is more than just your home and your current bank account balance. It includes things you (correctly) assume pass outside of probate, like investment and retirement accounts, as well as funds that don't come to your family until you die, like life insurance proceeds, and more. This is why you should consider estate planning: lowering the tax burden on your estate could help your family save tens of thousands in taxes, significantly adding to the inheritance of your loved ones. And whether you realize it or not, the assets that count for estate tax purposes may well add up to more than $2 million, which is when Massachusetts estate tax will begin to affect you. The amount your estate will owe will depend on how far above this threshold you are, but in most cases makes the money invested in planning is well worth it if. |

We're Here to Help.OR

|

The $2 Million Estate Tax Threshold in Massachusetts

If your assets are worth more than $2 million, your estate will owe Massachusetts estate tax when you die.

Are you close to the taxable threshold? Most people are closer than they think.

For example: If you have a $1 million life insurance policy, stock holdings, an average 401(k) retirement and you own a home, chances are, you’re definitely close if not over the limit. And most of these assets will only grow in value as time goes by. It’s worth it to explore the tax saving benefits you could employ with conscientious estate planning. You may not think of yourself as “rich,” but Massachusetts will take its share upon your death unless you structure your assets in a way to benefit your heirs the most.

Are you close to the taxable threshold? Most people are closer than they think.

For example: If you have a $1 million life insurance policy, stock holdings, an average 401(k) retirement and you own a home, chances are, you’re definitely close if not over the limit. And most of these assets will only grow in value as time goes by. It’s worth it to explore the tax saving benefits you could employ with conscientious estate planning. You may not think of yourself as “rich,” but Massachusetts will take its share upon your death unless you structure your assets in a way to benefit your heirs the most.

Taking Advantage of the Spousal Exemption

In Massachusetts, you can give an unlimited amount to your spouse on your death without triggering the estate tax. Many people do not realize it, and therefore fail to take advantage of an easy way to minimize their family's tax burden.

How it works is this: both spouses have a specific kind of trust, which allows the first spouse to die to pass all of their assets into the other spouse's trust. This inheritance, no matter the size, does not trigger any estate tax because of the spousal exemption. If done correctly, when the surviving spouse passes, they can use both their and their spouse's exemption. Translated: the second spouse to die now has a $4 million exemption instead of a $2 million exemption.

The key is in creating the trusts. If you don't do this, the surviving spouse will still have the unlimited exemption, but ultimately the family as a whole will have the lower, $2 million exemption which will apply when the surviving spouse passes.

If you are married, and think your total taxable estate will exceed the $2 million limit, there is literally no reason not to take advantage of this estate planning tool. The estate tax savings will dwarf whatever you have to pay to have those trusts created for you.

How it works is this: both spouses have a specific kind of trust, which allows the first spouse to die to pass all of their assets into the other spouse's trust. This inheritance, no matter the size, does not trigger any estate tax because of the spousal exemption. If done correctly, when the surviving spouse passes, they can use both their and their spouse's exemption. Translated: the second spouse to die now has a $4 million exemption instead of a $2 million exemption.

The key is in creating the trusts. If you don't do this, the surviving spouse will still have the unlimited exemption, but ultimately the family as a whole will have the lower, $2 million exemption which will apply when the surviving spouse passes.

If you are married, and think your total taxable estate will exceed the $2 million limit, there is literally no reason not to take advantage of this estate planning tool. The estate tax savings will dwarf whatever you have to pay to have those trusts created for you.

Consider Family Gifts as an Estate Tax Strategy

If you plan on leaving money to your children, or anyone else, after your death, and you know your estate is over the $2 million Massachusetts exemption amount, why not begin to impart financial gifts now? You will get to see the benefits your money can provide to your heirs and you will actively reduce the amount they would have to pay in taxes after your death.

Giving is a sensible way to expedite the inheritance process without having to pay estate taxes, but state and federal laws have been established to put a limit on your ability to exercise this option.

You can give away a certain amount each year per receiver without incurring any federal gift tax ($18,000 in 2024). Any such gifts made more than three years before your passing will not be counted in your taxable estate. Who counts as a "receiver?" Anyone. If you have an adult child who is married, you can give $18,000 to your child and another $18,000 to their spouse. If they have children, you can give $18,000 for each child into a trust or education savings plan.

Married couples can give away $36,000 per year to each receiver, or $18,000 per spouse. If they have three adult children with spouses, and each gave the full $18,000 to each child and each spouse, they could reduce the value of their taxable estate by $216,000 each year, while getting assets into the hands of their loved ones sooner.

If you own a business or an interest in a closely held company (closely held means it is not publicly traded, which is the case for most small businesses), there are ways to leverage your giving limits. The IRS permits a discount on the valuation of a business because it is not publicly traded, and if you gift minority interests, there is an additional allowable discount. What this means is that you can give away an interest that may have a real value of more than $18,000, but can be valued for gift and estate tax purposes at $18,000 or less. It is also worth considering this kind of asset in a gifting strategy, because it does not necessarily take liquid assets that you may need in your own lifetime out of your pocket, and helps facilitate the transfer if you intend for family members eventually to take over the business.

If you have the financial flexibility to live without some of the assets in your estate, or if you own interests in a closely held company that can be gradually transferred to your heirs during your lifetime, gifting is another strategy you should consider taking advantage of to minimize the eventual tax burden on your family.

Giving is a sensible way to expedite the inheritance process without having to pay estate taxes, but state and federal laws have been established to put a limit on your ability to exercise this option.

You can give away a certain amount each year per receiver without incurring any federal gift tax ($18,000 in 2024). Any such gifts made more than three years before your passing will not be counted in your taxable estate. Who counts as a "receiver?" Anyone. If you have an adult child who is married, you can give $18,000 to your child and another $18,000 to their spouse. If they have children, you can give $18,000 for each child into a trust or education savings plan.

Married couples can give away $36,000 per year to each receiver, or $18,000 per spouse. If they have three adult children with spouses, and each gave the full $18,000 to each child and each spouse, they could reduce the value of their taxable estate by $216,000 each year, while getting assets into the hands of their loved ones sooner.

If you own a business or an interest in a closely held company (closely held means it is not publicly traded, which is the case for most small businesses), there are ways to leverage your giving limits. The IRS permits a discount on the valuation of a business because it is not publicly traded, and if you gift minority interests, there is an additional allowable discount. What this means is that you can give away an interest that may have a real value of more than $18,000, but can be valued for gift and estate tax purposes at $18,000 or less. It is also worth considering this kind of asset in a gifting strategy, because it does not necessarily take liquid assets that you may need in your own lifetime out of your pocket, and helps facilitate the transfer if you intend for family members eventually to take over the business.

If you have the financial flexibility to live without some of the assets in your estate, or if you own interests in a closely held company that can be gradually transferred to your heirs during your lifetime, gifting is another strategy you should consider taking advantage of to minimize the eventual tax burden on your family.

Using an Irrevocable Trust To Minimize Estate Tax Liability

The marital trust strategy is not available if you are not married. For some families, it may also not be sufficient to fully address the estate tax issue, if the couple's combined assets will exceed the increased $4 million threshold. In those cases, You may be able to use irrevocable trusts as another way to give away assets but maintain some kind of say about how they are used. For example, you could place assets into a trust that allows you to receive income from the assets but earmarks the assets themselves for a beneficiary (a child or grandchild, for example).

There are two important considerations in exercising this strategy. First, the trust must be irrevocable. This means once you create it you can't change your mind and pull the assets out of trust. This is not always a fit for every family's financial situation, and should be discussed with an estate planning attorney.

Second, the gift limits described about also apply to gifts to irrevocable trusts. This means you can't simply put $1 million in trust and avoid all tax liability. Again, understanding whether an irrevocable trust is the right strategy for you requires advice from an estate planning lawyer and full discussion of all of your options.

There are two important considerations in exercising this strategy. First, the trust must be irrevocable. This means once you create it you can't change your mind and pull the assets out of trust. This is not always a fit for every family's financial situation, and should be discussed with an estate planning attorney.

Second, the gift limits described about also apply to gifts to irrevocable trusts. This means you can't simply put $1 million in trust and avoid all tax liability. Again, understanding whether an irrevocable trust is the right strategy for you requires advice from an estate planning lawyer and full discussion of all of your options.

If Estate Taxes Are Unavoidable

There are always ways to minimize estate tax liability, but sometimes the tax cannot be avoided entirely. It is equally important in that situation to consider the practicalities of paying the estate tax without disrupting the rest of your legacy. For example, if all that passes through your probate estate is land and other non-liquid assets but there is a $150,000 tax bill due, your heirs may have to sell property you intended to stay in the family in order to pay that bill.

This is why it may be appropriate for you to take steps in your planning to ensure that there are some liquid (case or easily redeemable for cash) assets in your estate. One strategy is to take out a life insurance policy for the purpose of providing available funds to pay taxes. Another is to make sure that some amount of your cash savings or investment portfolio is directed to your estate, rather than directly to specific beneficiaries, to ensure adequate cash in the estate.

This is why it may be appropriate for you to take steps in your planning to ensure that there are some liquid (case or easily redeemable for cash) assets in your estate. One strategy is to take out a life insurance policy for the purpose of providing available funds to pay taxes. Another is to make sure that some amount of your cash savings or investment portfolio is directed to your estate, rather than directly to specific beneficiaries, to ensure adequate cash in the estate.

How We Can Help

Our experienced estate planning attorneys are ready to help you analyze your estate tax situation and put together the right plan to maximize the amount of your legacy that will go to your heirs. You can use the button below to schedule a free information call, or give us a call at (781) 784-2322.

Meet Our Estate Planning Lawyers

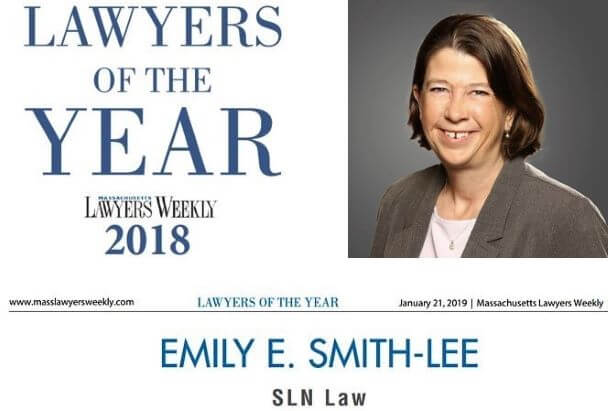

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.