How to Talk About Your Estate Plan with Your Family

Strategies for Open and Effective Estate Planning ConversationsIt’s a subject few people want to discuss and yet it’s extremely important and beneficial: talking about your estate plan with your family before something happens.

Have you ever known someone who has torn the house apart looking for a will when a loved one passes because they didn't know if the deceased had written a will, what it said, or even where it was? Or a family who suffers from division, hurt feelings, and stress because what was in a parent's will was a surprise? Or a family trying to settle an estate with no idea where all of the assets and accounts are? It happens more often than you might think, and you can spare your loved ones a lot of heartache by discussing your affairs and plans with them ahead of time. |

We're Here to Help.OR

|

When is the Right Time to Talk About Your Estate Plan?

Ideally, you will have some conversation with your family soon after you finalize your plan. This way the decisions you have made and the reasons for them are fresh in your mind, as are the answers to any questions you may have asked your estate planning attorney. At a minimum at this point you will want to make sure the people who are designated as personal representative, health care proxy and power of attorney are aware of their roles and where to find the documents when needed.

This is not always possible or practical, and often many years may go by between when you first create your estate plan and when your children are grown and ready to have this conversation. Some events that serve as a good reminder to schedule a time to talk with your family about what is in your plan:

This is not always possible or practical, and often many years may go by between when you first create your estate plan and when your children are grown and ready to have this conversation. Some events that serve as a good reminder to schedule a time to talk with your family about what is in your plan:

- You have updated or revised your estate plan;

- There has been a change in the family- the death of a family member, marriage of your children, a divorce, new grandchildren, etc.;

- You are downsizing and moving from the family home;

- You or your spouse have received a serious medical diagnosis or are beginning to show signs of cognitive decline.

What Are the Critical Estate Planning Topics to Discuss With Your Family?

Regardless of what is in your estate plan, here are some things you want to make sure you discuss with any family members who will be involved:

These topics do not require you to go into detail about what bequests you have made under your will. It is up to you whether to share that information, but there are good reasons to do so. For example, if one of your adult children assumes you plan on leaving the family business to them, or another is expecting to inherit the family home, it only seems fair to discuss your plans with them, especially if their assumptions are incorrect, so that they can be better prepared for their inheritance when it comes. Or you may have specific reasons for naming one of your children as personal representative instead of the other- better to talk about it now than have hurt feelings or misunderstanding after you are gone, while your children are already in a stressful and sad situation.

Finally, you may also want to have a separate conversation with the individuals designated as your personal representative, health care proxy, and durable power of attorney. Massachusetts does not recognize specific advance health care directives as legally binding- instead, you designate a person you trust to make the decision for you. If you have strong opinions about what kind of medical care you do and do not want, it is helpful to make sure the person you have designated as your health care proxy knows what those wishes and opinions are. In the same way, you could benefit from making sure the person who holds your power of attorney understands how you would like certain things to be handled if you are incapacitated.

- Who is your health care proxy (the person with legal authority to make medical decisions for you if you are unable);

- Who holds your durable power of attorney (the person with legal authority to make financial and legal decisions for you if you are unable);

- Who is your personal representative (formerly known as executor);

- What life insurance policies do you have and where are they located;

- What investment accounts do you have, who are the designated beneficiaries, and where is that information located; and

- Where are your original estate planning documents stored.

These topics do not require you to go into detail about what bequests you have made under your will. It is up to you whether to share that information, but there are good reasons to do so. For example, if one of your adult children assumes you plan on leaving the family business to them, or another is expecting to inherit the family home, it only seems fair to discuss your plans with them, especially if their assumptions are incorrect, so that they can be better prepared for their inheritance when it comes. Or you may have specific reasons for naming one of your children as personal representative instead of the other- better to talk about it now than have hurt feelings or misunderstanding after you are gone, while your children are already in a stressful and sad situation.

Finally, you may also want to have a separate conversation with the individuals designated as your personal representative, health care proxy, and durable power of attorney. Massachusetts does not recognize specific advance health care directives as legally binding- instead, you designate a person you trust to make the decision for you. If you have strong opinions about what kind of medical care you do and do not want, it is helpful to make sure the person you have designated as your health care proxy knows what those wishes and opinions are. In the same way, you could benefit from making sure the person who holds your power of attorney understands how you would like certain things to be handled if you are incapacitated.

Tips on Managing the Conversation

Depending on your family dynamics, this conversation can be straightforward or emotionally fraught, or anywhere in between. The topic of your own demise is most likely hard for you, and hard for your family members. Some or all of your family members may also feel awkward talking about money and the division of assets, or their may be pre-existing conflicts that are brought to the fore by a conversation about inheritance. Here are some tips for managing the conversation:

You probably also have stories to relate that can help your family think about this issue. For example, you may have a specific experience- positive or negative- with how your own parents or grandparents set up their estate plan, and how that impacted you when they passed. Show your family that you know this is part of life, that you have been through it too, and that you are trying to make things as easy as possible for them when the inevitable occurs, hopefully a long way in the future.

Talking with your family about your estate plan isn’t always clear cut or easy, but it’s a vital step along your path to ensuring peace of mind and legacy for your loved ones.

- Prepare what you want to say ahead of time to avoid lulls in conversation or confusion.

- Think about what questions your family is likely to have about your estate plan so that you can answer their questions clearly and without feeling upset or defensive, especially if you will be talking about things that may be a surprise to some.

- Plan for a time when you can all be together without distractions and make sure your family has advance notice that you want to discuss your estate plan, so they can be mentally prepared as well;

- Consider advance one-to-one conversations if there is any individual that you think will be surprised and upset by what you have planned, whether that's because they expected a role like the personal representative, or to step into the family business, or anything else that is important to them but not in your plan.

You probably also have stories to relate that can help your family think about this issue. For example, you may have a specific experience- positive or negative- with how your own parents or grandparents set up their estate plan, and how that impacted you when they passed. Show your family that you know this is part of life, that you have been through it too, and that you are trying to make things as easy as possible for them when the inevitable occurs, hopefully a long way in the future.

Talking with your family about your estate plan isn’t always clear cut or easy, but it’s a vital step along your path to ensuring peace of mind and legacy for your loved ones.

How We Can Help

We can't talk to your family for you, but we can help you think through your options based on your unique family circumstances, and create a comprehensive estate plan that you can understand well enough to explain it to your loved ones. You can use the button below to schedule a free information call, or give us a call at (781) 784-2322.

Meet Our Estate Planning Lawyers

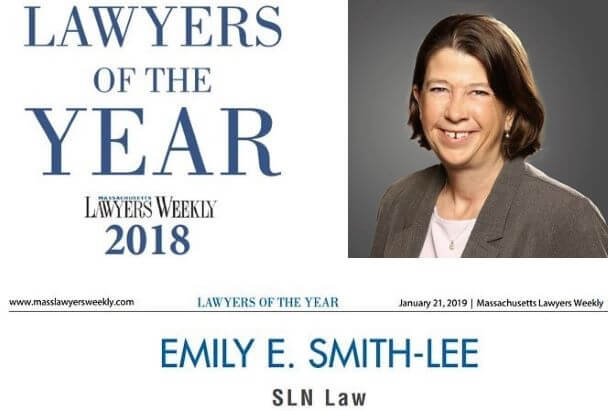

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.