Safeguard Your Small Business from Costly Legal Errors

Avoid These Common Small Business Legal Mistakes That Can Cost You MoneySmall business owners face the risk of making legal mistakes every day. They are required to make quick decisions. Few step into the role with experience as manager, employee, director of operations and head of sales – just to name a few of the hats you’re expected to wear.

The truth is that all of these common mistakes can be avoided, if you just know what to look out for and seek proactive legal advice for your business before they turn into real problems. Avoid the following four legal pitfalls by carving out time for preparation and legal guidance. It could be invaluable in the long run. |

We're Here to Help.OR

|

Legal Mistake #1 – Failing to Organize & Register the Business Entity

Entrepreneurs may put off creating a business entity due to cost or lack of experience with the process. However, forming the entity can legally separate business liabilities from personal assets and provide a level of protection to both.

There are many resources available to teach first-time business owners about the difference between legal structures, such as sole proprietorships, partnerships and corporations. Once a legal structure is selected, business owners are then responsible for adhering to federal and state regulations around registering for operation.

Business attorneys can guide owners through the process or handle it entirely. Either way, it is crucial to complete every step, so that the business owner is not open to future liability.

There are many resources available to teach first-time business owners about the difference between legal structures, such as sole proprietorships, partnerships and corporations. Once a legal structure is selected, business owners are then responsible for adhering to federal and state regulations around registering for operation.

Business attorneys can guide owners through the process or handle it entirely. Either way, it is crucial to complete every step, so that the business owner is not open to future liability.

Legal Mistake #2 – Not Putting Agreements in Writing

Never work without a written contract. It forces all parties to agree to exact terms. However, contracts do require time to work through and finalize.

Small business owners may justify “handshake deals” because they are engaging known vendors and contractors. In practice, if an issue in these circumstances goes to court, it typically ends up as a “he said/she said” fight with no guarantee of how it will resolve.

Business owners can work with their lawyer to establish a standard contract template that reflects the parties a business regularly works with – vendors, contractors, employees, customers, etc.

The clearer the contract, the easier it is to enforce if the business ends up in court for any reason.

Small business owners may justify “handshake deals” because they are engaging known vendors and contractors. In practice, if an issue in these circumstances goes to court, it typically ends up as a “he said/she said” fight with no guarantee of how it will resolve.

Business owners can work with their lawyer to establish a standard contract template that reflects the parties a business regularly works with – vendors, contractors, employees, customers, etc.

The clearer the contract, the easier it is to enforce if the business ends up in court for any reason.

Legal Mistake #3 – Failing to Protect Brand & Intellectual Property

Many small business owners do not distinguish intellectual property (IP) with its unique categories or take time to determine how to best protect each type.

Do not wait until a competitor attempts to steal the “secret sauce” or claim rights to it. It will likely be too late to secure legal protection.

An easy first step is to inventory both current IP assets and the intent for future IP development, and then create a plan to protect it all appropriately.

- Patents protect ideas or concepts which are novel and non-obvious.

- Trademarks protect words, designs or phrases which serve as the “brand” for a product or service.

- Copyrights protect creative expression fixed in a tangible medium, such as prose, music and video.

- Trade secret law protects commercial information which is not disclosed to the public.

Do not wait until a competitor attempts to steal the “secret sauce” or claim rights to it. It will likely be too late to secure legal protection.

An easy first step is to inventory both current IP assets and the intent for future IP development, and then create a plan to protect it all appropriately.

Legal Mistake #4 – Not Preparing for Employment Issues

Taking on employees is a major milestone for small businesses. Good employees will help fast-track business growth. Subpar employees may intentionally or unintentionally undermine business objectives. The worst-case scenario is when bad employees become expensive legal liabilities by raising claims that may be baseless but require time and money to resolve. There are also mistakes in wage and hour compliance that are easy to make and can lead to genuine liability to a disgruntled employee.

Avoid this problem by developing a legal strategy in advance that addresses all the relevant laws around hiring, compensation, and managing and dismissing employees. This strategy should include creating an employment policy that covers terms of employment, disciplinary procedures and procedures for filing and dealing with complaints.

Hiring the right employees is important, but issues arise unexpectedly. Preparing for them in advance is the best way to protect business interests.

Avoid this problem by developing a legal strategy in advance that addresses all the relevant laws around hiring, compensation, and managing and dismissing employees. This strategy should include creating an employment policy that covers terms of employment, disciplinary procedures and procedures for filing and dealing with complaints.

Hiring the right employees is important, but issues arise unexpectedly. Preparing for them in advance is the best way to protect business interests.

How We Can Help

At slnlaw, we specialize in providing comprehensive legal support to small businesses. Our experienced attorneys can help you navigate the complexities of business formation, draft and review contracts, protect your intellectual property, and develop robust employment policies. By partnering with us, you can avoid common legal pitfalls, safeguard your business assets, and focus on what you do best—growing your business. Let us handle the legal intricacies so you can operate with confidence and peace of mind. You can use the button below to schedule a free information call, or give us a call at (781) 784-2322.

Meet Our Business Attorneys

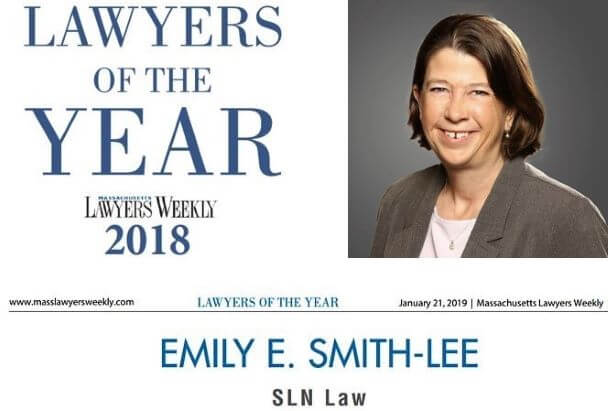

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years with a focus on business litigation. In 2009, she started the firm that since became slnlaw, and has grown it from a solo practice to a five-attorney firm with multiple practice areas. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year. She has written a book on employment law: Rules of the Road, What You Need to Know About Employment Laws in Massachusetts, and helped hundreds of small business owners with contracts, business transactions, employment law advice, business incorporation, and risk management. She has also litigated business disputes in state and federal courts.

Rebecca Rogers: Rebecca is a 2006 graduate of Boston College Law School, and has worked with slnlaw since 2013. She previously worked as an intellectual property litigation attorney for Fish & Richardson in Boston, Massachusetts, and clerked for the Massachusetts Supreme Judicial Court. Rebecca has helped clients with business contracts, employment contracts, and employment law advice.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna has helped many small business owners with simple and complex business incorporation, contract review, advice and analysis regarding business disputes, employment law advice, and advice about business succession considerations as part of estate planning.

Elijah Bresley: Eli is a 2014 graduate of Seton Hall Law school, and has worked with slnlaw since 2020. He previously worked for a boutique employment law firm outside of Boston, and then for the Labor and Employment department of a large Boston firm. He also spent a year clerking for the judges of the Superior Court in Hartford, Connecticut. Eli has helped our small business clients with employment law advice and defense of employment-related lawsuits in MCAD and state and federal courts.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped clients litigate business disputes in state and federal courts, and advised business owners about succession considerations as part of their estate planning.