Medicaid Trusts: Protecting Moderate-Income Families

A Trust That Matters Even if You Are Not Rich: Protecting Assets From Long Term Care CostsAs we age, our healthcare needs increase, and long-term care becomes a possibility for many. Unfortunately, the cost of long-term care is often exorbitant, and can easily wipe out a moderate-income family's savings.

Many families in this income bracket delay seeking estate planning advice until it is too late to plan for this. They are not alone- 60% of Americans of all income levels do not have estate plans. In the case of a moderate income family, however, there is the additional problem of believing the myth that estate planning is only for the wealthy. In fact, when it comes to planning for assisted living or long term care, exactly the opposite is true. To understand why this is the case, it is important to understand how paying for long term care works. |

We're Here to Help.OR

|

Understanding Who Pays for Long Term Care

Medicare or private health insurance only covers short-term care in a facility. If you need extended care lasting more than a month or two, you must bear the long-term care expenses yourself.

Medicaid, the federal program that assists low-income Americans, does cover long-term care costs, but eligibility is a prerequisite. Because Medicaid is a needs-based program, having excess income or assets will render you ineligible. Excess income may not disqualify you, but much of that income will have to be used to cover the monthly costs. Excess assets (over $3,000 in value) will disqualify you from Medicaid or MassHealth assistance.

If your primary asset is your home, it will not be sold out from underneath you, but MassHealth will place a lien on the home to recover the costs of your care from the value of your home after you and your spouse are gone.

Medicaid, the federal program that assists low-income Americans, does cover long-term care costs, but eligibility is a prerequisite. Because Medicaid is a needs-based program, having excess income or assets will render you ineligible. Excess income may not disqualify you, but much of that income will have to be used to cover the monthly costs. Excess assets (over $3,000 in value) will disqualify you from Medicaid or MassHealth assistance.

If your primary asset is your home, it will not be sold out from underneath you, but MassHealth will place a lien on the home to recover the costs of your care from the value of your home after you and your spouse are gone.

Planning Ahead to Protect Your Assets: The Medicaid Trust

Fortunately, there are ways to plan for care that will not completely erase your legacy- but you have to do it at least five years before you or your spouse needs care.

One effective way to do this is by creating a Medicaid trust. A Medicaid trust is a legal tool used to protect assets from the high cost of long-term care while still allowing individuals to qualify for Medicaid. The way it works is that you place the asset (usually your home or other real estate) into an irrevocable trust. You will lose the right to take that asset out of trust, but you can receive income generated from the asset, and the trust will specify who gets the assets when you are gone.

The timing can be critical. Medicaid has what is known as a "five year look back." This means that if you try to place assets out of reach within five years of applying for care, those assets will still be counted when determining your eligibility for assistance.

By creating a Medicaid trust, families can transfer their assets to the trust, which is managed by a trustee. The assets themselves cannot be taken out of trust, but the income from those assets can be used to support the person who created the trust. If this is done at least five years before you need Medicaid assistance, those savings and assets in the trust are protected and can be passed on to your heirs even if you receive Medicaid assistance.

Because the trust is irrevocable, it is not the right tool for everyone at every stage of life. Most often people begin considering this option when they are in their sixties or seventies, when they likely can meet the five year look back requirement but also are at a stage in life where they know they plan to remain in their home without selling or moving, or have enough financial security to place some other assets out of reach and still meet their cost of living needs.

One effective way to do this is by creating a Medicaid trust. A Medicaid trust is a legal tool used to protect assets from the high cost of long-term care while still allowing individuals to qualify for Medicaid. The way it works is that you place the asset (usually your home or other real estate) into an irrevocable trust. You will lose the right to take that asset out of trust, but you can receive income generated from the asset, and the trust will specify who gets the assets when you are gone.

The timing can be critical. Medicaid has what is known as a "five year look back." This means that if you try to place assets out of reach within five years of applying for care, those assets will still be counted when determining your eligibility for assistance.

By creating a Medicaid trust, families can transfer their assets to the trust, which is managed by a trustee. The assets themselves cannot be taken out of trust, but the income from those assets can be used to support the person who created the trust. If this is done at least five years before you need Medicaid assistance, those savings and assets in the trust are protected and can be passed on to your heirs even if you receive Medicaid assistance.

Because the trust is irrevocable, it is not the right tool for everyone at every stage of life. Most often people begin considering this option when they are in their sixties or seventies, when they likely can meet the five year look back requirement but also are at a stage in life where they know they plan to remain in their home without selling or moving, or have enough financial security to place some other assets out of reach and still meet their cost of living needs.

Why Long Term Care Planning is Especially Critical for Moderate Income Families

A wealthy family generally has the luxury of some liquid assets available to pay for the costs of care, while still preserving a legacy for their heirs. They also probably have enough assets that they would not qualify for Medicaid assistance, no matter how much planning they do.

For moderate income families, most of their wealth is usually tied up in the family home, and/or in assets that are not immediately reachable, like retirement savings or life insurance proceeds. The home is also frequently the main asset they intend to leave to their children.

This leaves these families in a precarious position if someone needs long term care- there is not sufficient cash to pay the $8,000-$12,000 per month cost of care, but on paper they have an asset that disqualifies them from receiving assistance without essentially pledging that asset to the state.

For moderate income families, most of their wealth is usually tied up in the family home, and/or in assets that are not immediately reachable, like retirement savings or life insurance proceeds. The home is also frequently the main asset they intend to leave to their children.

This leaves these families in a precarious position if someone needs long term care- there is not sufficient cash to pay the $8,000-$12,000 per month cost of care, but on paper they have an asset that disqualifies them from receiving assistance without essentially pledging that asset to the state.

What You Can Do Now to Protect Your Family

The first step is to make a rough inventory of your assets to determine whether a Medicaid trust might be right for you. If you have substantial equity in your home and less than $100,000 in liquid assets (most commonly checking, savings and/or investment accounts), you may be in a position where a year of assisted living would erase your liquid assets and begin to eat into the value of your home.

The second step is consider your age and health (and that of your spouse, if applicable) to determine whether the time is right for long term care planning. Generally, unless you or your spouse have a medical problem that makes the need for care likely, a Medicaid trust is not the right answer until you are in your sixties or seventies. This is because the cost of protecting assets includes putting them permanently out of your reach, something you may not need or want to do until you are closer to needing assistance. The key is not to miss the five year mark, so that your planning is effective to meet your goals.

The third step is to consult with an experienced estate planning attorney to get started on your plan. They can help you understand the options available to you and create the documents needed to accomplish your goals.

The second step is consider your age and health (and that of your spouse, if applicable) to determine whether the time is right for long term care planning. Generally, unless you or your spouse have a medical problem that makes the need for care likely, a Medicaid trust is not the right answer until you are in your sixties or seventies. This is because the cost of protecting assets includes putting them permanently out of your reach, something you may not need or want to do until you are closer to needing assistance. The key is not to miss the five year mark, so that your planning is effective to meet your goals.

The third step is to consult with an experienced estate planning attorney to get started on your plan. They can help you understand the options available to you and create the documents needed to accomplish your goals.

How We Can Help

Our experienced attorneys specialize in creating Medicaid trusts tailored to your unique needs. We are dedicated to helping moderate-income families protect their hard-earned assets and ensure access to essential long-term care. Contact us today to secure your financial future and preserve your legacy. You can use the button below to schedule a free information call, or give us a call at (781) 784-2322.

Meet Our Estate Planning Lawyers

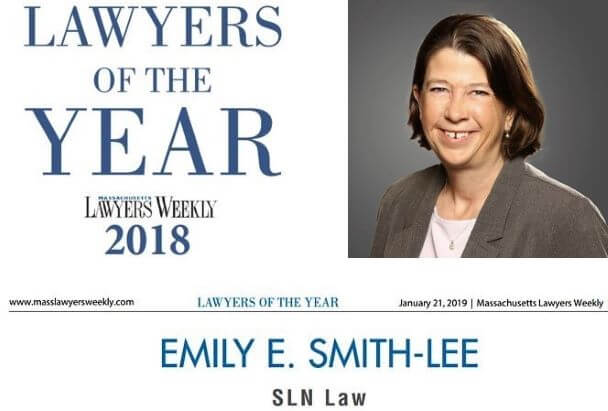

Emily Smith-Lee is the owner and founder of slnlaw. She is a 1996 graduate of Boston College Law School. She was previously a partner at the Boston office of a large international firm, where she worked for thirteen years before starting the firm that became slnlaw in 2009. She has been recognized as Massachusetts Superlawyer each year since 2013, and in 2018 earned recognition as one of Massachusetts Lawyers Weekly's Lawyers of the Year.

Jenna Ordway: Jenna is a 2013 graduate of Quinnipiac Law School, and also earned an LLM in Taxation from Boston University in 2015. She has been affiliated with slnlaw since 2011, first as a law clerk and then as an attorney. Jenna has been recognized since 2019 as a "Rising Star" by Massachusetts Superlawyers. Jenna wrote a book on estate planning: The Road to Peace of Mind: What You Need to Know About Estate Planning. Jenna has helped many individuals and families with planning to protect their legacies and loved ones, and planning for the future and succession of their businesses.

Sharleen Tinnin: Sharleen is a 2010 graduate of Northeastern University School of Law, and earned her LLM in estate planning from Western New England Scool of Law in 2016. She has been with slnlaw since 2023. Prior to joining slnlaw, she worked with King, Tilden, McEttrick & Brink, P.C. on complex civil litigation matters. She previously worked for the United States Department of Justice, and received an "Excellence in Justice" award in 2017. Sharleen has helped many clients with planning for their legacies and their future, and navigating the probate process in Massachusetts after the death of a loved one.